- Afhalen na 1 uur in een winkel met voorraad

- Gratis thuislevering in België vanaf € 30

- Ruim aanbod met 7 miljoen producten

- Afhalen na 1 uur in een winkel met voorraad

- Gratis thuislevering in België vanaf € 30

- Ruim aanbod met 7 miljoen producten

Zoeken

Reeksen: boeken uit de reeks Springer Finance

-

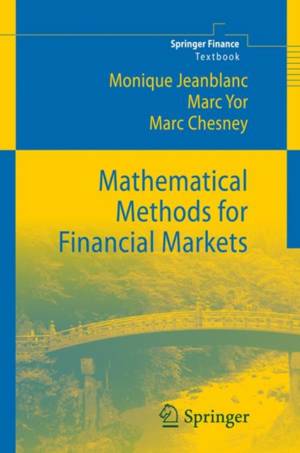

Mathematical Methods for Financial Markets

Monique Jeanblanc, Marc Yor, Marc Chesney

- Hardcover | Engels | Springer Finance

- Unlike other texts available in the field, this book is written to be accessible to both mathematicians and practitioners Rather than provide full pro... Lees meer

€ 125,95Levering 1 à 2 weken€ 125,95Levering 1 à 2 weken -

Exponential Functionals of Brownian Motion and Related Processes

Marc Yor

- Paperback | Engels | Springer Finance | Springer Finance Lecture Notes

- This monograph contains: - ten papers written by the author, and co-authors, between December 1988 and October 1998 about certain exponential function... Lees meer

€ 52,95Levertermijn 1 à 4 weken€ 52,95Levertermijn 1 à 4 weken -

Risk-Neutral Valuation

Nicholas H Bingham, Rüdiger Kiesel

- Paperback | Engels | Springer Finance

- This second edition - completely up to date with new exercises - provides a comprehensive and self-contained treatment of the probabilistic theory beh... Lees meer

€ 76,95Levering 1 à 2 weken€ 76,95Levering 1 à 2 weken -

Derivative Securities and Difference Methods

You-Lan Zhu, Xiaonan Wu, I-Liang Chern, Zhi-Zhong Sun

- Paperback | Engels | Springer Finance

- This book is mainly devoted to finite difference numerical methods for solving partial differential equations (PDEs) models of pricing a wide variety ... Lees meer

€ 259,45Levering 2 à 3 weken€ 259,45Levering 2 à 3 weken -

The Price of Fixed Income Market Volatility

Antonio Mele, Yoshiki Obayashi

- Hardcover | Engels | Springer Finance

- Fixed income volatility and equity volatility evolve heterogeneously over time, co-moving disproportionately during periods of global imbalances and e... Lees meer

€ 68,95Levertermijn 1 à 4 weken€ 68,95Levertermijn 1 à 4 weken -

Term-Structure Models

Damir Filipovic

- Hardcover | Engels | Springer Finance | Springer Finance Textbooks

- Changing interest rates constitute one of the major risk sources for banks, insurance companies, and other financial institutions. Modeling the term-s... Lees meer

€ 79,45Levertermijn 1 à 4 weken€ 79,45Levertermijn 1 à 4 weken -

Credit Risk: Modeling, Valuation and Hedging

Tomasz R Bielecki, Marek Rutkowski

- Hardcover | Engels | Springer Finance

- This book will be an important reference for practitioners involved with managing portfolios sensitive to credit risk. Graduate students and researche... Lees meer

€ 126,95Levertermijn 1 à 4 weken€ 126,95Levertermijn 1 à 4 weken -

Stochastic Models for Prices Dynamics in Energy and Commodity Markets

Fred Espen Benth, Paul Krühner

- Paperback | Engels | Springer Finance

- This monograph presents a theory for random field models in time and space, viewed as stochastic processes with values in a Hilbert space, to model th... Lees meer

€ 137,45Levertermijn 1 à 4 weken€ 137,45Levertermijn 1 à 4 weken -

Mathematical Finance

Ernst Eberlein, Jan Kallsen

- Paperback | Engels | Springer Finance

- Taking continuous-time stochastic processes allowing for jumps as its starting and focal point, this book provides an accessible introduction to the s... Lees meer

€ 94,95Levertermijn 1 à 4 weken€ 94,95Levertermijn 1 à 4 weken -

Continuous-Time Asset Pricing Theory

Robert A Jarrow

- Paperback | Engels | Springer Finance | Springer Finance Textbooks

- Yielding new insights into important market phenomena like asset price bubbles and trading constraints, this is the first textbook to present asset pr... Lees meer

€ 52,95Levertermijn 1 à 4 weken€ 52,95Levertermijn 1 à 4 weken -

Visual Explorations in Finance

- Paperback | Engels | Springer Finance

- Self-organizing maps (SOM) have proven to be of significant economic value in the areas of finance, economic and marketing applications. As a result, ... Lees meer

€ 111,95Levering 1 à 2 weken€ 111,95Levering 1 à 2 weken -

Uncertain Volatility Models

Robert Buff

- Paperback | Engels | Springer Finance | Springer Finance Lecture Notes

- Many introductory books on mathematical finance also outline some com- puter algorithms. My goal is to contribute a closer look at algorithmic issues ... Lees meer

€ 52,95Levertermijn 1 à 4 weken€ 52,95Levertermijn 1 à 4 weken -

Option Prices as Probabilities

Christophe Profeta, Bernard Roynette, Marc Yor

- Paperback | Engels | Springer Finance | Springer Finance Lecture Notes

- Discovered in the seventies, Black-Scholes formula continues to play a central role in Mathematical Finance. We recall this formula. Let (B, t? 0; F, ... Lees meer

€ 52,95Levertermijn 1 à 4 weken€ 52,95Levertermijn 1 à 4 weken -

Modelling, Pricing, and Hedging Counterparty Credit Exposure

Giovanni Cesari, John Aquilina, Niels Charpillon, Zlatko Filipovic, Gordon Lee, Ion Manda

- Hardcover | Engels | Springer Finance

- It was the end of 2005 when our employer, a major European Investment Bank, gave our team the mandate to compute in an accurate way the counterparty c... Lees meer

€ 158,45Levertermijn 1 à 4 weken€ 158,45Levertermijn 1 à 4 weken -

Financial Modeling

Stephane Crepey

- Paperback | Engels | Springer Finance | Springer Finance Textbooks

- Backward stochastic differential equations (BSDEs) provide a general mathematical framework for solving pricing and risk management questions of finan... Lees meer

€ 63,45Levertermijn 1 à 4 weken€ 63,45Levertermijn 1 à 4 weken -

Financial Modeling Under Non-Gaussian Distributions

Eric Jondeau, Ser-Huang Poon, Michael Rockinger

- Paperback | Engels | Springer Finance

- Non-Gaussian distributions are the key theme of this book which addresses the causes and consequences of non-normality and time dependency in both ass... Lees meer

€ 244,45Levering 2 à 3 weken€ 244,45Levering 2 à 3 weken -

Mathematical Models of Financial Derivatives

Yue-Kuen Kwok

- Hardcover | Engels | Springer Finance | Springer Finance Textbooks

- This book contains a comprehensive account of pricing models of financial derivatives, including exotic equity options, interest rate products and cre... Lees meer

€ 105,45Levertermijn 1 à 4 weken€ 105,45Levertermijn 1 à 4 weken -

Derivative Securities and Difference Methods

You-Lan Zhu, Xiaonan Wu, I-Liang Chern, Zhi-Zhong Sun

- Hardcover | Engels | Springer Finance

- This book is mainly devoted to finite difference numerical methods for solving partial differential equations (PDEs) models of pricing a wide variety ... Lees meer

€ 167,95Levering 1 à 2 weken€ 167,95Levering 1 à 2 weken -

Mathematical Models of Financial Derivatives

Yue-Kuen Kwok

- Paperback | Engels | Springer Finance | Springer Finance Textbooks

- This book contains a comprehensive account of pricing models of financial derivatives, including exotic equity options, interest rate products and cre... Lees meer

€ 73,95Levertermijn 1 à 4 weken€ 73,95Levertermijn 1 à 4 weken -

Financial Markets Theory

Emilio Barucci

- Paperback | Engels | Springer Finance

- The first book to combine the latest discussion on financial market theory with precision mathematics and how practical results influence research, Fi... Lees meer

€ 76,95Levering 1 à 2 weken€ 76,95Levering 1 à 2 weken -

Stochastic Calculus for Finance II

Steven Shreve

- Paperback | Engels | Springer Finance

- Stochastic Calculus for Finance evolved from the first ten years of the Carnegie Mellon Professional Master's program in Computational Finance. Lees meer

€ 99,45Levering 2 à 3 weken€ 99,45Levering 2 à 3 weken -

Interest Rate Models - Theory and Practice

Damiano Brigo, Fabio Mercurio

- E-book | Engels | Springer Finance

- The 2nd edition of this successful book has several new features. The calibration discussion of the basic LIBOR market model has been enriched conside... Lees meer

€ 137,79Onmiddellijk beschikbaar€ 137,79Onmiddellijk beschikbaar -

Semiparametric Modeling of Implied Volatility

Matthias R Fengler

- Paperback | Engels | Springer Finance | Springer Finance Lecture Notes

- The implied volatility surface is a key financial variable for the pricing and the risk management of plain vanilla and exotic options portfolios alik... Lees meer

€ 79,45Levertermijn 1 à 4 weken€ 79,45Levertermijn 1 à 4 weken -

Contract Theory in Continuous-Time Models

Jaksa Cvitanic, Jianfeng Zhang

- Hardcover | Engels | Springer Finance

- In recent years there has been a significant increase of interest in continuous-time Principal-Agent models, or contract theory, and their application... Lees meer

€ 147,95Levertermijn 1 à 4 weken€ 147,95Levertermijn 1 à 4 weken