- Afhalen na 1 uur in een winkel met voorraad

- Gratis thuislevering in België vanaf € 30

- Ruim aanbod met 7 miljoen producten

- Afhalen na 1 uur in een winkel met voorraad

- Gratis thuislevering in België vanaf € 30

- Ruim aanbod met 7 miljoen producten

Omschrijving

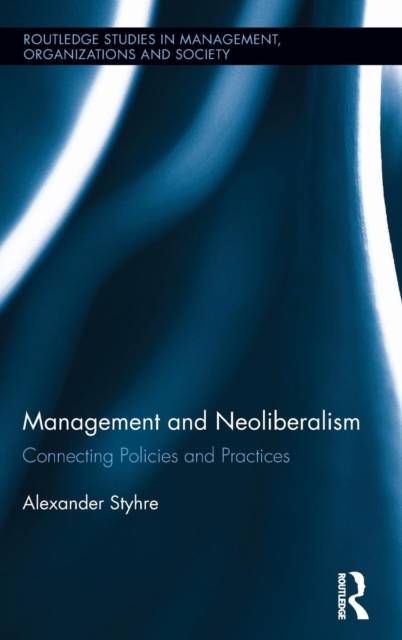

After the financial collapse of 2008 and the bailing out of banks in the US and the UK, the long-term viability of the neoliberal doctrine has come under new scrutiny. The elimination of regulatory control, the financialization of the economy including the growth of increasingly complex financial innovations, and the dominance of a rentier class have all been subject to thorough criticism. Despite the unexpected meltdown of the financial system and the substantial costs for restoring the finance industry, critics contend that the same decision-makers remain in place and few substantial changes to regulatory control have been made.

Even though neoliberal thinking strongly stresses the role of the market and market-based transactions, the organization theory and management literature has been marginally concerned with neoliberalism as a political agenda and economic policy. This book examines the consequences of neoliberalism for management thinking and management practice. Managerial practices in organizations are fundamentally affected by a political agenda emphasizing competition and innovation. Concepts such as auditing, corporate social responsibility, shareholder value, and boundariless careers are some examples of managerial terms and frameworks that are inextricably entangled with the neoliberal agenda. This book introduces the literature on neoliberalism, its history and controversies, and demonstrates where neoliberal thinking has served to rearticulate managerial practice, including in the areas of corporate governance, human resource management, and regulatory control of organizations.

Specificaties

Betrokkenen

- Auteur(s):

- Uitgeverij:

Inhoud

- Aantal bladzijden:

- 242

- Taal:

- Engels

- Reeks:

- Reeksnummer:

- nr. 29

Eigenschappen

- Productcode (EAN):

- 9780415737241

- Verschijningsdatum:

- 24/03/2014

- Uitvoering:

- Hardcover

- Formaat:

- Genaaid

- Afmetingen:

- 157 mm x 229 mm

- Gewicht:

- 453 g

Alleen bij Standaard Boekhandel

Beoordelingen

We publiceren alleen reviews die voldoen aan de voorwaarden voor reviews. Bekijk onze voorwaarden voor reviews.