- Afhalen na 1 uur in een winkel met voorraad

- Gratis thuislevering in België vanaf € 30

- Ruim aanbod met 7 miljoen producten

- Afhalen na 1 uur in een winkel met voorraad

- Gratis thuislevering in België vanaf € 30

- Ruim aanbod met 7 miljoen producten

Omschrijving

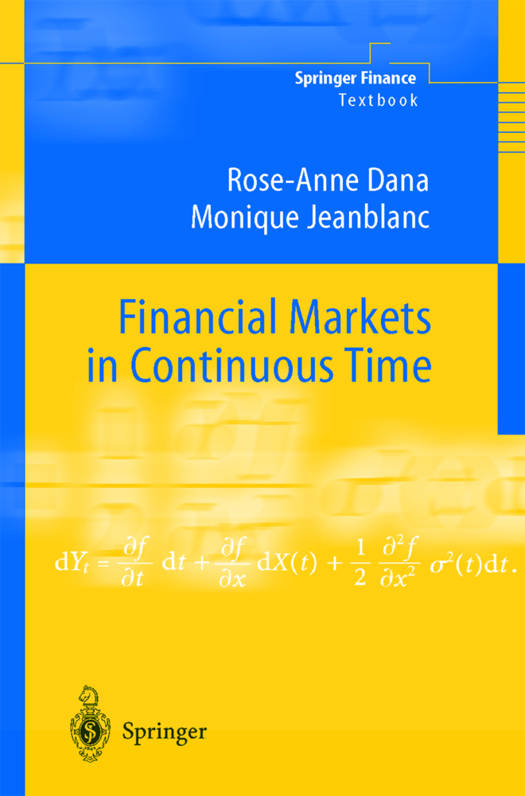

This book explains key financial concepts, mathematical tools and theories of mathematical finance. The range of topics covered is very broad for an introductory text. The book is organized in four parts. The first brings together a number of results from discrete-time models. The second develops stochastic continuous-time models for the valuation of financial assets (the Black-Scholes formula and its extensions), for optimal portfolio and consumption choice, and for obtaining the yield curve and pricing interest rate products. The third part recalls some concepts and results of general equilibrium theory and applies this in financial markets. The last part is more advanced and tackles market incompleteness and the valuation of exotic options in a complete market.

Specificaties

Betrokkenen

- Auteur(s):

- Vertaler(s):

- Uitgeverij:

Inhoud

- Aantal bladzijden:

- 324

- Taal:

- Engels

- Reeks:

Eigenschappen

- Productcode (EAN):

- 9783540434030

- Verschijningsdatum:

- 26/11/2002

- Uitvoering:

- Hardcover

- Formaat:

- Genaaid

- Afmetingen:

- 156 mm x 234 mm

- Gewicht:

- 653 g

Alleen bij Standaard Boekhandel

Beoordelingen

We publiceren alleen reviews die voldoen aan de voorwaarden voor reviews. Bekijk onze voorwaarden voor reviews.