- Afhalen na 1 uur in een winkel met voorraad

- Gratis thuislevering in België vanaf € 30

- Ruim aanbod met 7 miljoen producten

- Afhalen na 1 uur in een winkel met voorraad

- Gratis thuislevering in België vanaf € 30

- Ruim aanbod met 7 miljoen producten

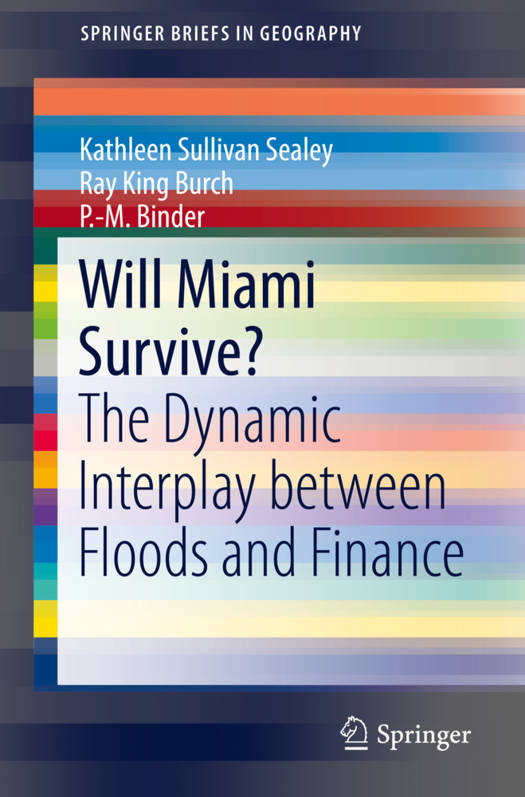

Will Miami Survive?

The Dynamic Interplay Between Floods and Finance

Kathleen Sullivan Sealey, Ray King Burch, P -M BinderOmschrijving

This SpringerBrief uses a complexity perspective to integrate risk, finance, and ecological issues in Miami, USA. It focuses on how the modern financial system, particularly the mortgage market, perceives and manages the risk of climate change. Authors Kathleen Sealey, Ray King Burch and P.-M. Binder offer the case study of South Florida to illustrate how landscapes can be either re-purposed to function ecologically when residents relocate or rebuilt to reduce the threat of future flooding, the tools needed to make these decisions, and how financial systems view and influence them. While the need to integrate financial markets into coastal (and environmental) management is increasingly recognized, the difficulty of this task is made greater by the speed of financial innovation and the obscurity and complexity of its practices. This book will discuss the innovative Southeast Florida Regional Climate Compact, and the success of public-private partnerships in planning and adapting to sea level rise, but also the broad disconnect with the cash-and-credit-driven real estate market of South Florida.

The book presents an interdisciplinary approach to the understanding of the coupled human (including finance) and natural systems in coastal cities, thus breaking new ground in the approach towards sustainability research and education. The final chapter introduces the social component of resilience which include pre-disaster outreach with and the potential for decision theory to help people understand and manage risk.

Specificaties

Betrokkenen

- Auteur(s):

- Uitgeverij:

Inhoud

- Aantal bladzijden:

- 75

- Taal:

- Engels

- Reeks:

Eigenschappen

- Productcode (EAN):

- 9783319790190

- Verschijningsdatum:

- 30/05/2018

- Uitvoering:

- Paperback

- Formaat:

- Trade paperback (VS)

- Afmetingen:

- 156 mm x 234 mm

- Gewicht:

- 140 g

Alleen bij Standaard Boekhandel

Beoordelingen

We publiceren alleen reviews die voldoen aan de voorwaarden voor reviews. Bekijk onze voorwaarden voor reviews.