- Afhalen na 1 uur in een winkel met voorraad

- Gratis thuislevering in België vanaf € 30

- Ruim aanbod met 7 miljoen producten

- Afhalen na 1 uur in een winkel met voorraad

- Gratis thuislevering in België vanaf € 30

- Ruim aanbod met 7 miljoen producten

Zoeken

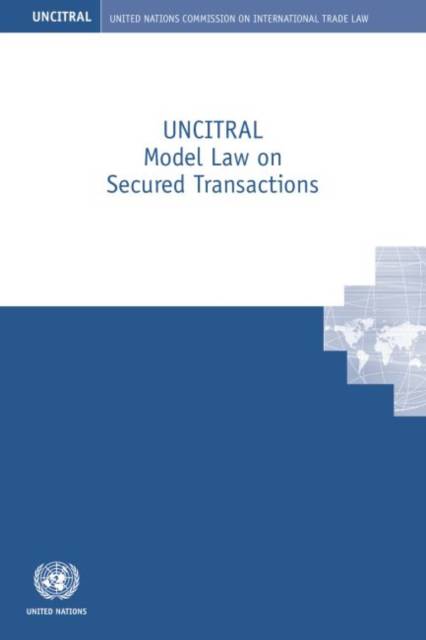

UNCITRAL model law on secured transactions

United Nations: Commission on International Trade Law

Paperback

€ 44,45

+ 88 punten

Omschrijving

Deals with security interests in all types of tangible and intangible movable property, such as goods, receivables, bank accounts, negotiable instruments, negotiable documents, non-intermediated securities and intellectual property with few exceptions, such as intermediated securities.

Specificaties

Betrokkenen

- Auteur(s):

- Uitgeverij:

Inhoud

- Aantal bladzijden:

- 88

Eigenschappen

- Productcode (EAN):

- 9789211338560

- Verschijningsdatum:

- 3/04/2017

- Uitvoering:

- Paperback

- Afmetingen:

- 240

Alleen bij Standaard Boekhandel

+ 88 punten op je klantenkaart van Standaard Boekhandel

Beoordelingen

We publiceren alleen reviews die voldoen aan de voorwaarden voor reviews. Bekijk onze voorwaarden voor reviews.