- Afhalen na 1 uur in een winkel met voorraad

- Gratis thuislevering in België vanaf € 30

- Ruim aanbod met 7 miljoen producten

- Afhalen na 1 uur in een winkel met voorraad

- Gratis thuislevering in België vanaf € 30

- Ruim aanbod met 7 miljoen producten

Zoeken

Omschrijving

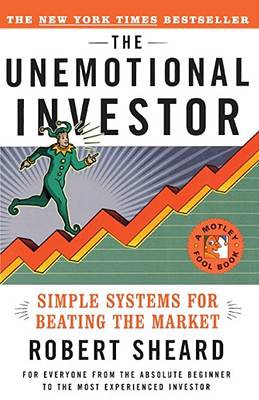

Investing in Stocks -- Without Investing in Time, Tears, or Terror

When Robert Sheard decided to bite the bullet and get into the market, he wasn't the typical Wall Street player, didn't have years of trading experience, and didn't have an M.B.A. What he did have was the know-how. As one of the top stock researchers for The Motley Fool -- the widely popular and fiercely irreverent financial site that launched the bestselling The Motley Fool Investment Guide and The Motley Fool's You Have More Than You Think -- Sheard developed mechanical, emotion-free formulas for analyzing stocks. Now he shares his insights to help you earn gains that will crush market averages. The Unemotional Investor teaches you:

* How to evaluate stocks

* What numbers to look for and how to compare them

* When to buy and when to sell

* How to manage the portfolio you create

* Two investing models you can use -- one of which requires no math, no experience, and about fifteen minutes of work per year!

Like other books created by The Motley Fool, The Unemotional Investor presents an easygoing approach to a subject often shrouded in mystery, making it easy for even rank beginners to take the first steps toward reaping the rewards of a low-maintenance, high-profit portfolio.

When Robert Sheard decided to bite the bullet and get into the market, he wasn't the typical Wall Street player, didn't have years of trading experience, and didn't have an M.B.A. What he did have was the know-how. As one of the top stock researchers for The Motley Fool -- the widely popular and fiercely irreverent financial site that launched the bestselling The Motley Fool Investment Guide and The Motley Fool's You Have More Than You Think -- Sheard developed mechanical, emotion-free formulas for analyzing stocks. Now he shares his insights to help you earn gains that will crush market averages. The Unemotional Investor teaches you:

* How to evaluate stocks

* What numbers to look for and how to compare them

* When to buy and when to sell

* How to manage the portfolio you create

* Two investing models you can use -- one of which requires no math, no experience, and about fifteen minutes of work per year!

Like other books created by The Motley Fool, The Unemotional Investor presents an easygoing approach to a subject often shrouded in mystery, making it easy for even rank beginners to take the first steps toward reaping the rewards of a low-maintenance, high-profit portfolio.

Specificaties

Betrokkenen

- Auteur(s):

- Uitgeverij:

Inhoud

- Aantal bladzijden:

- 240

- Taal:

- Engels

- Reeks:

Eigenschappen

- Productcode (EAN):

- 9780684853758

- Verschijningsdatum:

- 13/04/1999

- Uitvoering:

- Paperback

- Formaat:

- Trade paperback (VS)

- Afmetingen:

- 142 mm x 218 mm

- Gewicht:

- 322 g

Alleen bij Standaard Boekhandel

+ 53 punten op je klantenkaart van Standaard Boekhandel

Beoordelingen

We publiceren alleen reviews die voldoen aan de voorwaarden voor reviews. Bekijk onze voorwaarden voor reviews.