Wil je zeker zijn dat je cadeautjes op tijd onder de kerstboom liggen? Onze winkels ontvangen jou met open armen. Nu met extra openingsuren op zondag!

- Afhalen na 1 uur in een winkel met voorraad

- Gratis thuislevering in België vanaf € 30

- Ruim aanbod met 7 miljoen producten

Wil je zeker zijn dat je cadeautjes op tijd onder de kerstboom liggen? Onze winkels ontvangen jou met open armen. Nu met extra openingsuren op zondag!

- Afhalen na 1 uur in een winkel met voorraad

- Gratis thuislevering in België vanaf € 30

- Ruim aanbod met 7 miljoen producten

Zoeken

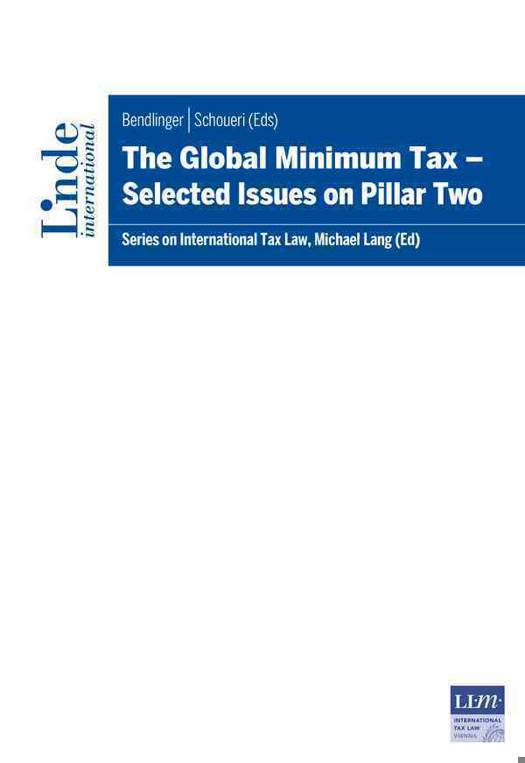

The Global Minimum Tax | Selected Issues on Pillar Two

Series on International Tax Law, Volume 143

€ 142,95

+ 285 punten

Omschrijving

Global Minimum Tax at a glance

The OECD's Global Minimum Tax is amongst the most discussed topics in the recent international tax law debate. The book provides for more than 25 individual but co-ordinated essays on multiple relevant topics on Pillar Two is structured as follows:

- General Topics including the legal status of the GloBE Model Rules, their relation to tax treaties and EU Law, the GloBE STTR, the specifics of jurisdictional blending, their impact on tax competition and on tax incentives

- Scoping topics including the computation of the EUR 750 million threshold, the definition of MNE Group, territorial allocation of CEs and excluded entities

- Charging provisions, including GloBE's rule order and the impact of the GloBE Model Rules on minority shareholders

- Computation of GloBE Income and Loss, including contributions on the adjustment of permanent differences and specifics of dividends and equity gains for purposes of the base determination

- Computation of Adjusted Covered Taxes, including the notion of covered taxes, the recognition of temporal differences and the territorial allocation of covered taxes

- Top-up Tax computation including contributions on the general correspondence of covered taxes and GloBE Income, the Substance-Based Income Exclusion, the specifics of Investment and Minority-Owned Constituent Entities and the general role of the QDMTT within the framework of Pillar Two

- Selected topics on the administration of GloBE, e.g., Safe Harbors and the identification of the taxpayer within the framework of Pillar Two

Specificaties

Betrokkenen

- Uitgeverij:

Inhoud

- Aantal bladzijden:

- 664

- Taal:

- Engels

- Reeks:

- Reeksnummer:

- nr. 143

Eigenschappen

- Productcode (EAN):

- 9783714303971

- Uitvoering:

- Paperback

- Afmetingen:

- 155 mm x 225 mm

Alleen bij Standaard Boekhandel

+ 285 punten op je klantenkaart van Standaard Boekhandel

Beoordelingen

We publiceren alleen reviews die voldoen aan de voorwaarden voor reviews. Bekijk onze voorwaarden voor reviews.