- Afhalen na 1 uur in een winkel met voorraad

- Gratis thuislevering in België vanaf € 30

- Ruim aanbod met 7 miljoen producten

- Afhalen na 1 uur in een winkel met voorraad

- Gratis thuislevering in België vanaf € 30

- Ruim aanbod met 7 miljoen producten

Zoeken

Omschrijving

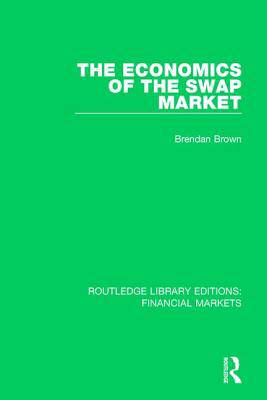

First published in 1989, The Economics of the Swap Market looks at how the swap has become a commonplace tool for corporations throughout the OECD world to 'lock-in' interest rates on their borrowing. The aim of The Economics of the Swap Market, is to contribute to a redressing of the balance. Subjects covered include both those conventionally falling within the scope of micro-economics and of macroeconomics, beginning with an examination of the forces behind the take-off the swap market and a formal setting out of key arbitrage relationships which hold in equilibrium between the swap markets on international capital flow.

Specificaties

Betrokkenen

- Auteur(s):

- Uitgeverij:

Inhoud

- Aantal bladzijden:

- 130

- Taal:

- Engels

- Reeks:

- Reeksnummer:

- nr. 6

Eigenschappen

- Productcode (EAN):

- 9781138560673

- Verschijningsdatum:

- 30/11/2017

- Uitvoering:

- Hardcover

- Formaat:

- Genaaid

- Afmetingen:

- 156 mm x 233 mm

- Gewicht:

- 399 g

Alleen bij Standaard Boekhandel

+ 305 punten op je klantenkaart van Standaard Boekhandel

Beoordelingen

We publiceren alleen reviews die voldoen aan de voorwaarden voor reviews. Bekijk onze voorwaarden voor reviews.