Bedankt voor het vertrouwen het afgelopen jaar! Om jou te bedanken bieden we GRATIS verzending (in België) aan op alles gedurende de hele maand januari.

- Afhalen na 1 uur in een winkel met voorraad

- In januari gratis thuislevering in België

- Ruim aanbod met 7 miljoen producten

Bedankt voor het vertrouwen het afgelopen jaar! Om jou te bedanken bieden we GRATIS verzending (in België) aan op alles gedurende de hele maand januari.

- Afhalen na 1 uur in een winkel met voorraad

- In januari gratis thuislevering in België

- Ruim aanbod met 7 miljoen producten

Zoeken

€ 50,95

+ 101 punten

Omschrijving

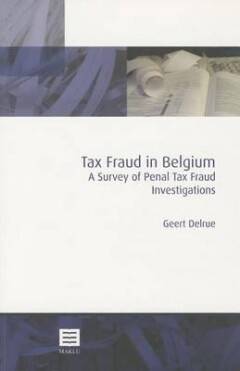

This book presents a professional course of action for penal investigations of tax fraud in Belgium. A penal tax fraud investigation is usually set up after a report from the Competent Tax Administration, although the police can also start an official investigation by making an official report. The essence of the penal investigation must necessarily concentrate on those essentials from which it can be discerned that the person or company in question is guilty of tax fraud. This must be gathered from the diverse interrogations by the responsible tax officials, the suspects, the accomplices, and the witnesses, and also from the variously obtained information and the analysis of the data gathered. Furthermore, the diversity of taxes (income tax, VAT, registration and inheritance taxes, customs and excise taxes, etc.) and the variety of tax offenses must be taken into account. Penal tax investigations differ from case to case. Each case has it own specification. In spite of these conclusions, it is possible to specify a series of procedures which can be followed in each case of tax fraud investigation. The content of this book is focused on the manner in which a penal tax dossier may be composed and what essentials the penal dossier must contain. Daily cases of tax fraud are treated, rather than the more advanced cases of tax fraud, such as VAT, carousels, and cash fund companies.

Specificaties

Betrokkenen

- Auteur(s):

- Uitgeverij:

Inhoud

- Aantal bladzijden:

- 124

- Taal:

- Engels

Eigenschappen

- Productcode (EAN):

- 9789046603000

- Verschijningsdatum:

- 31/12/2009

- Uitvoering:

- Paperback

- Formaat:

- Trade paperback (VS)

- Afmetingen:

- 157 mm x 239 mm

- Gewicht:

- 226 g

Alleen bij Standaard Boekhandel

+ 101 punten op je klantenkaart van Standaard Boekhandel

Beoordelingen

We publiceren alleen reviews die voldoen aan de voorwaarden voor reviews. Bekijk onze voorwaarden voor reviews.