- Afhalen na 1 uur in een winkel met voorraad

- Gratis thuislevering in België vanaf € 30

- Ruim aanbod met 7 miljoen producten

- Afhalen na 1 uur in een winkel met voorraad

- Gratis thuislevering in België vanaf € 30

- Ruim aanbod met 7 miljoen producten

Zoeken

Omschrijving

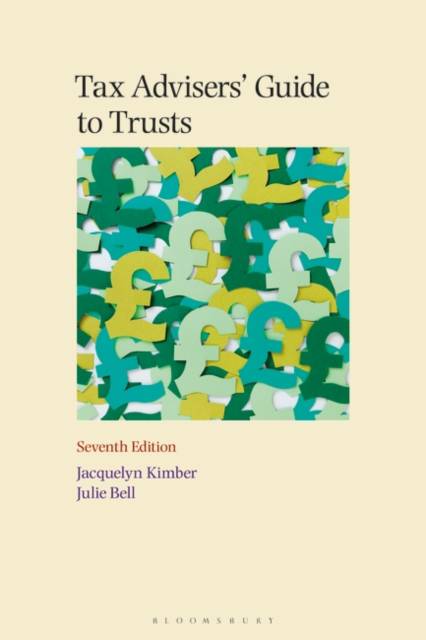

This title is written to provide tax advisers an understanding of the UK tax rules applicable to trusts resident in the UK or abroad, and the resultant tax liabilities of the trustees, settlors and beneficiaries, and opportunities for reducing those liabilities where possible.

As well as background to trusts and trustees powers and duties, the commentary deals with the main types of private trusts and the rules that apply to them - these cause practitioners the biggest headache. There are also important chapters in residence and domicile and foreign trusts, charitable trusts, and purpose and heritage trusts. A number of specialist areas such as protective and vulnerable persons trusts are also dealt with. This new edition covers the significant legislative changes reflected in several Finance Acts since the publication of the last edition in 2020. These include: - Updates to the Trust Registration Service by HMRC following new anti-money laundering regulations - Responses to the Government's consultation on the taxation of trusts - Changes to the rules for additions to existing settlements from July 2020 This updated edition also includes a review of recent tax cases, including Barclays Wealth Trustees (Jersey) Ltd & Anor v HMRC (excluded property trust status and the treatment of inter-trust transfers) and a number of more recent cases relating to the interpretation of trust legislation. A digital version of this title is available as part of our online tax resources. Contact our sales team to ask about access - professionalsales@bloomsbury.com.Specificaties

Betrokkenen

- Auteur(s):

- Uitgeverij:

Inhoud

- Aantal bladzijden:

- 1032

- Taal:

- Engels

Eigenschappen

- Productcode (EAN):

- 9781526523907

- Verschijningsdatum:

- 24/10/2024

- Uitvoering:

- Paperback

- Formaat:

- Trade paperback (VS)

- Afmetingen:

- 155 mm x 231 mm

- Gewicht:

- 1133 g

Alleen bij Standaard Boekhandel

+ 550 punten op je klantenkaart van Standaard Boekhandel

Beoordelingen

We publiceren alleen reviews die voldoen aan de voorwaarden voor reviews. Bekijk onze voorwaarden voor reviews.