- Afhalen na 1 uur in een winkel met voorraad

- In januari gratis thuislevering in België

- Ruim aanbod met 7 miljoen producten

- Afhalen na 1 uur in een winkel met voorraad

- In januari gratis thuislevering in België

- Ruim aanbod met 7 miljoen producten

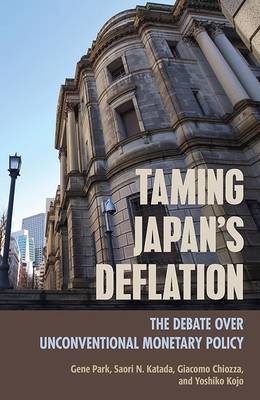

Taming Japan's Deflation

The Debate Over Unconventional Monetary Policy

Gene Park, Saori N Katada, Giacomo ChiozzaOmschrijving

Bolder economic policy could have addressed bouts of deflation in post-Bubble Japanese history, write Gene Park, Saori N. Katada, Giacomo Chiozza, and Yoshiko Kojo in Taming Japan's Deflation. Despite warnings from economists, intense political pressure, and "unconventional monetary policy" options to address this problem, Japan's central bank, the Bank of Japan (BOJ), resisted taking the bold actions that the authors believe would have helped.

With Prime Minister Abe Shinzo's return to power, Japan shifted course in early 2013 with the launch of his "Abenomics" economic agenda to reflate the economy and his appointment of a new leadership at the BOJ to achieve this goal. As Taming Japan's Deflation shows, the BOJ's resistance to bolder policy stemmed from entrenched policy ideas that were hostile to activist monetary policy. The authors explain how these policy ideas evolved over the BOJ's long history and gained dominance due to the closed nature of the policy network.

The explanatory power of policy ideas and networks suggests an inadequacy in the dominant framework for analysis of the politics of monetary policy derived from literature on central bank independence. This approach privileges the interaction between political principals and their agents, central bankers; but Taming Japan's Deflation shows that central bankers' views can be decisive in determining monetary policy. Addressing the challenges through institutional analysis, quantitative empirical tests, in-depth case studies, and structured comparison of other countries to Japan, the authors show that the adoption of aggressive monetary policy depends on bankers' established preceding policy ideas and policy network structure.

Specificaties

Betrokkenen

- Auteur(s):

- Uitgeverij:

Inhoud

- Aantal bladzijden:

- 264

- Taal:

- Engels

- Reeks:

Eigenschappen

- Productcode (EAN):

- 9781501728174

- Verschijningsdatum:

- 1/10/2018

- Uitvoering:

- Hardcover

- Formaat:

- Genaaid

- Afmetingen:

- 160 mm x 231 mm

- Gewicht:

- 566 g

Alleen bij Standaard Boekhandel

Beoordelingen

We publiceren alleen reviews die voldoen aan de voorwaarden voor reviews. Bekijk onze voorwaarden voor reviews.