- Afhalen na 1 uur in een winkel met voorraad

- Gratis thuislevering in België vanaf € 30

- Ruim aanbod met 7 miljoen producten

- Afhalen na 1 uur in een winkel met voorraad

- Gratis thuislevering in België vanaf € 30

- Ruim aanbod met 7 miljoen producten

Omschrijving

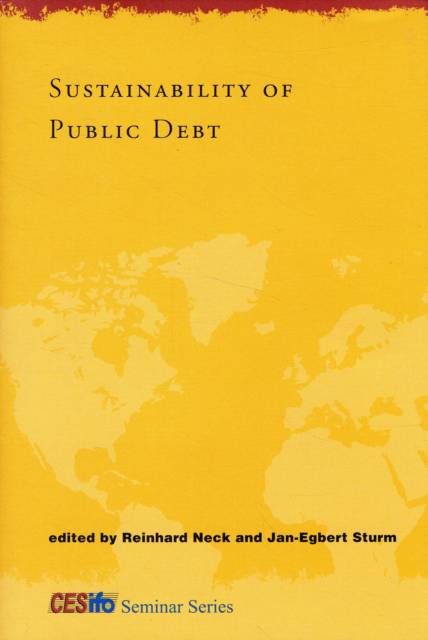

Theoretical and empirical perspectives on how fiscal policies in Europe and the United States can avoid government bankruptcy.

In recent decades, governments have built up substantial public debt, which is often accompanied by a growing public sector and fiscal policies that neglect long-term considerations. The contributors to this CESifo volume consider whether the development of public debt in the United States and six EU countries is sustainable--that is, whether fiscal policies in these countries can be continued without creating the potential for government bankruptcy. The sustainability of public debt presents a challenge not only to public policy design but also to economic theory. This collection is the first book-length analysis of the theoretical foundations of public debt sustainability concepts and their application to the empirical study of actual budgetary policies. Conditions for public debt sustainability are derived and applied to various institutional environments. Country studies cover the United States, Italy, the Netherlands, Austria, Denmark, the United Kingdom, and Switzerland, with special emphasis in the EU chapters on the fiscal criteria for entrance into the European Monetary Union and the Stability and Growth Pact. The contributors find that in most countries, fiscal policy turns out to be sustainable in the long run and that all countries (with the possible exception of Italy) were able to return to a sustainable path after a period of unsustainability.

Contributors

Torben M. Andersen, Roel M. W. J. Beetsma, Henning Bohn, Marco Buti, Sylvester Eijffinger, Lars P. Feld, Daniele Franco, Emma Galli, Olaf de Groot, Gottfried Haber, Jakob de Haan, Andrew Hughes Hallett, Svend E. Hougaard Jensen, Gebhard Kirchgässner, Reinhard Neck, Fabio Padovano, Lars Haagen Pedersen, Jan-Egbert Sturm, Koen Vermeylen

Specificaties

Betrokkenen

- Uitgeverij:

Inhoud

- Aantal bladzijden:

- 271

- Taal:

- Engels

- Reeks:

Eigenschappen

- Productcode (EAN):

- 9780262140980

- Verschijningsdatum:

- 1/06/2008

- Uitvoering:

- Hardcover

- Formaat:

- Ongenaaid / garenloos gebonden

- Afmetingen:

- 158 mm x 234 mm

- Gewicht:

- 508 g

Alleen bij Standaard Boekhandel

Beoordelingen

We publiceren alleen reviews die voldoen aan de voorwaarden voor reviews. Bekijk onze voorwaarden voor reviews.