- Afhalen na 1 uur in een winkel met voorraad

- Gratis thuislevering in België vanaf € 30

- Ruim aanbod met 7 miljoen producten

- Afhalen na 1 uur in een winkel met voorraad

- Gratis thuislevering in België vanaf € 30

- Ruim aanbod met 7 miljoen producten

Omschrijving

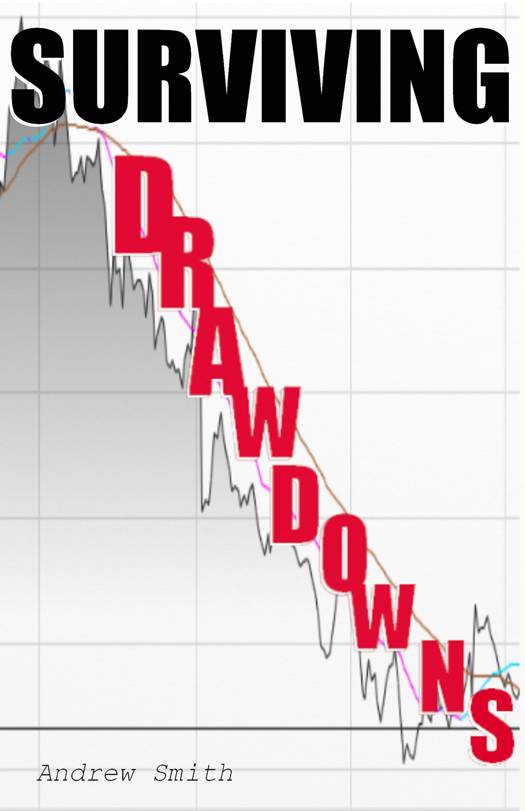

Thinking of trading for a living? Then you must know the trader's maxim: "Cut your losses and let your profits run."

Simple advice, so why do around 80% of retail traders do just the opposite?

Perhaps because, while it may be true that trading is simple and *anyone* can do it, human nature shows us that not anyone can do it *well*.

Losing money hurts and, in the market, everybody loses sometimes. Even experienced traders. The thing is, over time, they tend to lose less than they win. Beginners do the opposite. Over-estimating their skills and under-estimating the risks involved they are often surprised by unexpected or crippling losses.

Sometimes, losses pile up right at the start, when they've risked too much without really understanding what that risk is. Sometimes, it's after a winning streak, when lack of experience leads to overconfidence, extra leverage and a vicious turn of the market catches them loaded up and unprepared. Either way, it costs money they can't afford and, most of the time, didn't need to lose.

Surviving Drawdowns is a concise beginner's guide to psychology, systems and position sizing. It will help you avoid those early mistakes and keep you in the game long enough to learn how to play it well.

Surviving Drawdowns contains proven tips on how to create the trader's mind-set, how to build motivating objectives, how to avoid unnecessary losses and, perhaps most important of all, how not to let the market wear you down - financially or emotionally - until you've honed your skills enough to make the living you deserve.

So read Surviving Drawdowns and prepare yourself! It may not make you rich - only guts, time and brains can do that - but it *will* help you avoid those expensive, beginner's mistakes.

Specificaties

Betrokkenen

- Auteur(s):

- Uitgeverij:

Inhoud

- Aantal bladzijden:

- 60

- Taal:

- Engels

Eigenschappen

- Productcode (EAN):

- 9781370701742

- Verschijningsdatum:

- 26/10/2017

- Uitvoering:

- E-book

- Formaat:

- ePub

Alleen bij Standaard Boekhandel

Beoordelingen

We publiceren alleen reviews die voldoen aan de voorwaarden voor reviews. Bekijk onze voorwaarden voor reviews.