- Afhalen na 1 uur in een winkel met voorraad

- Gratis thuislevering in België vanaf € 30

- Ruim aanbod met 7 miljoen producten

- Afhalen na 1 uur in een winkel met voorraad

- Gratis thuislevering in België vanaf € 30

- Ruim aanbod met 7 miljoen producten

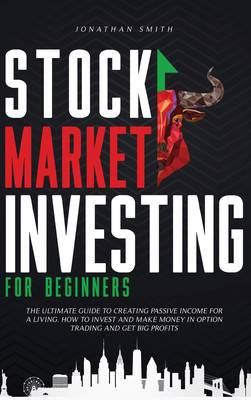

Stock Market Investing For Beginners

The Ultimate Guide To Creating Passive Income For A Living. How To Invest And Make Money In Option Trading And Get Big Profits (Forex, Swing, Day Strategies)

Jonathan SmithOmschrijving

Here we go... the markets are on the point of going down! What to do in cases like these? Is it time to invest, sell everything or wait?

The market downturns are always annoying, they come when you least expect it and they see mal most obvious and unavoidable, with the benefit of hindsight. But the truth is that we all wish we had sold everything on the eve of a drop in prices to buy back later at lower prices.

"Highlighting by the author"

In this book you will learn a proven method which comes from years of study of the most successful traders, to whom they have put their training in the stock markets at my disposal, and especially how to deal with both the best times to invest and the worst. In this book nothing is left to chance and the main causes of failure in this business are also analyzed, and what to do when the markets go down and how to recognize a trend reversal from a correction.

Like any business, also the choices made in managing your own and investing are dictated by our ideas and are therefore subject to the risk that those ideas are fallacious. The assumptions of economics is that man is a perfectly rational being who is able to accurately assess each situation and then calculate which action in that context ensures maximum profit with the lower risk.

In actual fact, however, when it comes to Investing, there is often asymmetric information, i.e. no information is available that is necessary for a truly considered choice. In this case, investment choices can be dictated by infatuation rather than a correct idea based on all the relevant information.

In this book you will discover methods to avoid the most common mistakes.

Here's just a little of what you'll discover inside:

- Breaking Down The Stock Market - Everything a Beginner Needs To Know

- All The Essential Market Terminology (and How To Remember It!)

- The Latest Strategies For Stock Market Investing

- Practical Methods For Low-Risk Trading and Managing Your Money

- 8 Must-Know Rules To Drastically Boost Your Chances of Success and Help You Avoid Costly Mistakes

- Step-By-Step Strategies to buy and sell Stocks, Shares, and More

- Tips and Tricks to get the most from your trading

- And Much More.......

So don't wait!

Scroll up and buy now to break into the stock market today!

Specificaties

Betrokkenen

- Auteur(s):

- Uitgeverij:

Inhoud

- Aantal bladzijden:

- 158

- Taal:

- Engels

Eigenschappen

- Productcode (EAN):

- 9781801115834

- Verschijningsdatum:

- 9/10/2020

- Uitvoering:

- Hardcover

- Formaat:

- Genaaid

- Afmetingen:

- 152 mm x 229 mm

- Gewicht:

- 381 g

Alleen bij Standaard Boekhandel

Beoordelingen

We publiceren alleen reviews die voldoen aan de voorwaarden voor reviews. Bekijk onze voorwaarden voor reviews.