- Afhalen na 1 uur in een winkel met voorraad

- Gratis thuislevering in België vanaf € 30

- Ruim aanbod met 7 miljoen producten

- Afhalen na 1 uur in een winkel met voorraad

- Gratis thuislevering in België vanaf € 30

- Ruim aanbod met 7 miljoen producten

Omschrijving

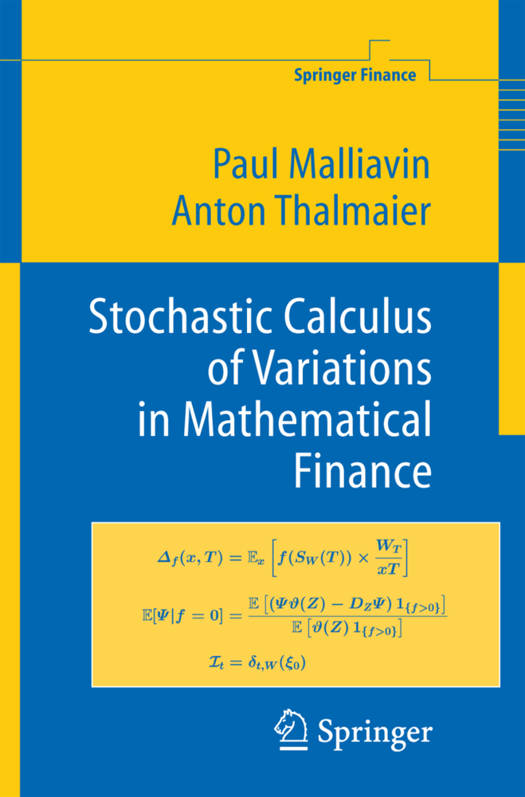

This extensive and up-to-date text demonstrates the relevance of Malliavin calculus for Mathematical Finance. It starts with an exposition from scratch of this theory. Greeks (price sensitivities) are reinterpreted in terms of Malliavin calculus. Integration by parts formulae provide stable Monte Carlo schemes for numerical valuation of digital options. Finite-dimensional projections of infinite-dimensional Sobolev spaces lead to Monte Carlo computations of conditional expectations useful for computing American options. Insider information is expressed as an infinite-dimensional drift. The last chapter gives an introduction to the same objects in the context of jump processes where incomplete markets appear.

Specificaties

Betrokkenen

- Auteur(s):

- Uitgeverij:

Inhoud

- Aantal bladzijden:

- 142

- Taal:

- Engels

- Reeks:

Eigenschappen

- Productcode (EAN):

- 9783540434313

- Verschijningsdatum:

- 3/11/2005

- Uitvoering:

- Hardcover

- Formaat:

- Genaaid

- Afmetingen:

- 162 mm x 242 mm

- Gewicht:

- 362 g

Alleen bij Standaard Boekhandel

Beoordelingen

We publiceren alleen reviews die voldoen aan de voorwaarden voor reviews. Bekijk onze voorwaarden voor reviews.