- Afhalen na 1 uur in een winkel met voorraad

- In januari gratis thuislevering in België

- Ruim aanbod met 7 miljoen producten

- Afhalen na 1 uur in een winkel met voorraad

- In januari gratis thuislevering in België

- Ruim aanbod met 7 miljoen producten

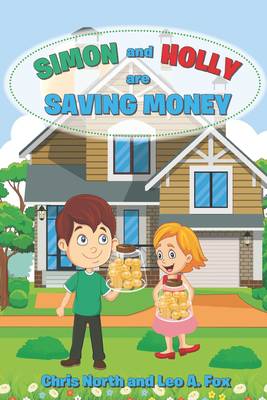

Simon and Holly are Saving Money

Academy of Young Entrepreneurs Series 1, Volume 3

Chris North, Leo A FoxOmschrijving

Thanks to the book "Simon and Holly are Saving Money" from the Academy of Young Entrepreneur series, publisher of Modern Business 2.0 ( www.cankris.com).

Your child will not have to wait until full maturity to start learning how to start making financially intelligent and wise decisions.

This book provides the necessary knowledge to ensure that a young person will not be unnecessarily exposed to financial mistakes and failures in the future.

The adventures of Simon and Holly, described in a simple and friendly manner, help to learn basic economic concepts so that your child:

- will grow up to be an aware and reasonable adult,

- become entrepreneurial, resourceful, and self-confident,

- make wise decisions in every aspect of life,

- won't have to learn from their mistakes.

Simon is implementing new habits into his life. He is helped by family and friends.

In the book you will learn:

- how to effectively save for a goal,

- how to plan expenses,

- how to prepare a register of expenses,

- how to deal with unexpected expenses,

- how to find additional activity (work, income source)

Simon and Holly learn how to create a habit of saving regularly rather than spending and borrowing money. They learn how to set a goal to save money for and how to achieve success through systematic work, patience, and determination.

Children learn how to prepare a list of payments, register expenses, how to manage money wisely, how to control their desires and not to spend money on unnecessary things.

In the following chapters, the children learn how to earn extra money and how to take advantage of free advertising for their activities. Finally, the siblings discover that the ads they see in the mainstream media are not a good source of information about finances.

highly recommend another book from our series for children "Simon and Holly are Saving Money"

Described in a simple and friendly way, the adventures of Simon and Holly will help your child learn basic economic concepts, teach them how to live well, and make it easier to understand the mysteries of the spiritual world.

You probably wish that your child:

- grow up to be a conscious and sensible adult,

- to be enterprising, resourceful and self-confident,

- to make wise decisions in every aspect of his/her life,

Remember that your child does not have to:

- learn from their mistakes,

- gain experience by getting into trouble and unnecessarily complicating their

adult life,

- wait until they are fully grown to start learning to make decisions,

You can protect your child from the mistakes you've made in the past:

- by beginning his or her education as early as age 6,

- using the knowledge of specialists,

- teaching them good habits and beliefs.

This is another volume in the series of financial education books.- Simon's New Habits.

- Simon and Holly are Shopping.

- Simon and Holly are going on Vacation.

- Simon is opening his own Business.

- Simon and Holly are forming a Partnership.

Specificaties

Betrokkenen

- Auteur(s):

- Uitgeverij:

Inhoud

- Aantal bladzijden:

- 116

- Taal:

- Engels

Eigenschappen

- Productcode (EAN):

- 9781778109409

- Verschijningsdatum:

- 22/04/2022

- Uitvoering:

- Paperback

- Formaat:

- Trade paperback (VS)

- Afmetingen:

- 152 mm x 229 mm

- Gewicht:

- 163 g

Alleen bij Standaard Boekhandel

Beoordelingen

We publiceren alleen reviews die voldoen aan de voorwaarden voor reviews. Bekijk onze voorwaarden voor reviews.