- Afhalen na 1 uur in een winkel met voorraad

- Gratis thuislevering in België vanaf € 30

- Ruim aanbod met 7 miljoen producten

- Afhalen na 1 uur in een winkel met voorraad

- Gratis thuislevering in België vanaf € 30

- Ruim aanbod met 7 miljoen producten

Zoeken

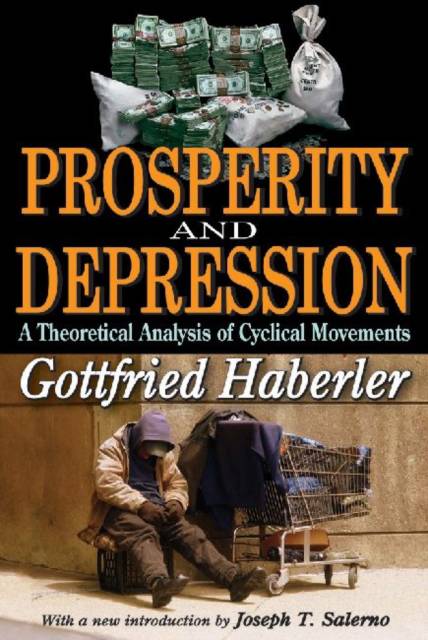

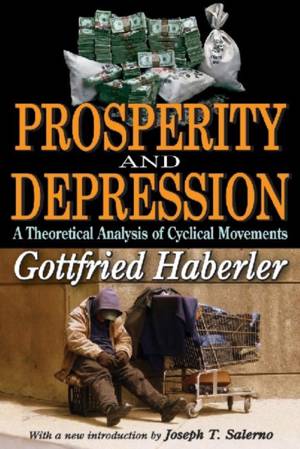

Prosperity and Depression

A Theoretical Analysis of Cyclical Movements

Gottfried Haberler

Paperback | Engels

€ 100,95

+ 201 punten

Uitvoering

Omschrijving

First issued in 1937 and then revised in 1957, Prosperity and Depression focuses on the task of analyzing existing theories of the business cycle and deriving a synthetic account of the nature and possible causes of economic fluctuations

Specificaties

Betrokkenen

- Auteur(s):

- Uitgeverij:

Inhoud

- Aantal bladzijden:

- 542

- Taal:

- Engels

Eigenschappen

- Productcode (EAN):

- 9781412842204

- Verschijningsdatum:

- 15/10/2011

- Uitvoering:

- Paperback

- Formaat:

- Trade paperback (VS)

- Afmetingen:

- 152 mm x 229 mm

- Gewicht:

- 748 g

Alleen bij Standaard Boekhandel

+ 201 punten op je klantenkaart van Standaard Boekhandel

Beoordelingen

We publiceren alleen reviews die voldoen aan de voorwaarden voor reviews. Bekijk onze voorwaarden voor reviews.