- Afhalen na 1 uur in een winkel met voorraad

- Gratis thuislevering in België vanaf € 30

- Ruim aanbod met 7 miljoen producten

- Afhalen na 1 uur in een winkel met voorraad

- Gratis thuislevering in België vanaf € 30

- Ruim aanbod met 7 miljoen producten

Zoeken

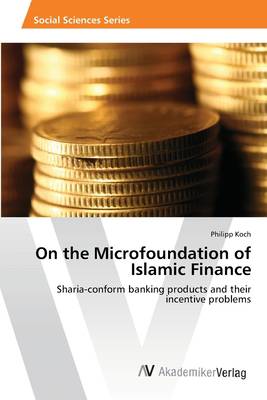

On the Microfoundation of Islamic Finance

Sharia-conform banking products and their incentive problems

Philipp Koch

Paperback | Engels

€ 35,45

+ 70 punten

Omschrijving

This book outlines the theoretical foundations of Islamic finance and summarizes empirical studies on current practices in Islamic banking. The main finding is that there is a discrepancy between the paradigmatic version of Islamic finance and the way it is currently implemented. The most substantial deviation is that profit and loss sharing contracts are only used on a low scale in Islamic banking when projects or individuals are funded. The microeconomic analysis of Shariah-conform profit and loss sharing contracts reveals possible reasons for this discrepancy. The payoffs in such agreements are favorable for the entrepreneurs because they are partially or fully insured against losses. In addition, the profit and loss sharing contracts are subject to market inefficiencies caused by asymmetric information distribution. Adverse selection might lead to poor quality of the projects that are sought to be funded Islamic, whereas moral hazard might lead to lower recovery rates of failing projects than what would be expected if entrepreneurs provided full effort. The conclusion is that the paradigmatic version of Islamic banking would likely imply more expensive funding than conventional banking.

Specificaties

Betrokkenen

- Auteur(s):

- Uitgeverij:

Inhoud

- Aantal bladzijden:

- 68

- Taal:

- Engels

Eigenschappen

- Productcode (EAN):

- 9783639676969

- Verschijningsdatum:

- 10/09/2014

- Uitvoering:

- Paperback

- Formaat:

- Trade paperback (VS)

- Afmetingen:

- 152 mm x 229 mm

- Gewicht:

- 113 g

Alleen bij Standaard Boekhandel

+ 70 punten op je klantenkaart van Standaard Boekhandel

Beoordelingen

We publiceren alleen reviews die voldoen aan de voorwaarden voor reviews. Bekijk onze voorwaarden voor reviews.