- Afhalen na 1 uur in een winkel met voorraad

- Gratis thuislevering in België vanaf € 30

- Ruim aanbod met 7 miljoen producten

- Afhalen na 1 uur in een winkel met voorraad

- Gratis thuislevering in België vanaf € 30

- Ruim aanbod met 7 miljoen producten

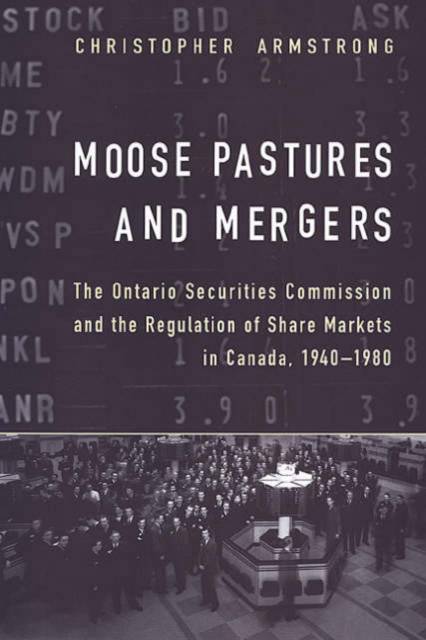

Moose Pastures and Mergers

The Ontario Securities Commission and the Regulation of Share Markets in Canada, 1940-1980

Chris ArmstrongOmschrijving

Long before the spectacular collapse of Bre-X in 1997, the Canadian capital markets had their share of swindlers and crooks. In the boom times after Second World War, hard-sell speculative mining ventures, pushing what often amounted to a few acres of moose pasture, riddled over-the-counter markets and the TSE. It was in this context that the Ontario Securities Commission developed into Canada's leading securities regulator. Following the war, the OSC concerned itself primarily with fraudsters and attempts to reign in Toronto's boiler rooms, but by the mid-sixties increasingly sophisticated markets and a series of scandals culminating in the Windfall affair resulted in a rewriting of the Securities Act and a widening of the OSC's investor protection mandate. The seventies tested the Commission's new powers as increased corporate merger activity brought the phrase "insider-trading" into the popular lexicon.

Surprisingly, considering that capital markets have such a profound impact on Canada's well-being, this is the first thorough study of the their post-war evolution and regulation. Moose Pastures and Mergers takes off where the author's acclaimed previous work, Blue Skies and Boiler Rooms: Buying and Selling Securities in Canada, 1870-1940, left off. With an ear for a good story - seedy personalities, bunglers and guileless victims abound - and a scholar's rigour, Armstrong has met the protean beast of share markets head on and revealed its shape for the timid or the merely baffled. Essential reading for business journalists, securities lawyers, academics, and interested investors.

Winner of the J.J. Talman Award presented by the Ontario Historical Society

Specificaties

Betrokkenen

- Auteur(s):

- Uitgeverij:

Inhoud

- Aantal bladzijden:

- 432

- Taal:

- Engels

- Reeks:

Eigenschappen

- Productcode (EAN):

- 9780802035103

- Verschijningsdatum:

- 15/06/2001

- Uitvoering:

- Hardcover

- Formaat:

- Genaaid

- Afmetingen:

- 160 mm x 235 mm

- Gewicht:

- 825 g

Alleen bij Standaard Boekhandel

Beoordelingen

We publiceren alleen reviews die voldoen aan de voorwaarden voor reviews. Bekijk onze voorwaarden voor reviews.