- Afhalen na 1 uur in een winkel met voorraad

- Gratis thuislevering in België vanaf € 30

- Ruim aanbod met 7 miljoen producten

- Afhalen na 1 uur in een winkel met voorraad

- Gratis thuislevering in België vanaf € 30

- Ruim aanbod met 7 miljoen producten

Omschrijving

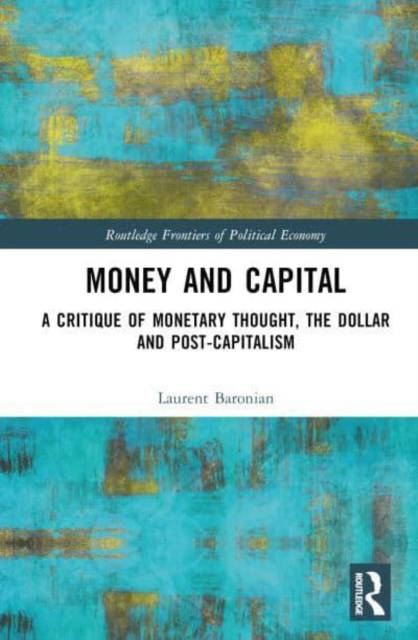

This book renews the Marxian theory of the general equivalent by highlighting the contradiction between the social functions of money (unit of account, means of circulation) and its private functions (store of value, accumulation).

It draws a clear distinction between the monetary base and the commodity base of money and thus avoids the confusion between money and credit on the one hand, and money and capital on the other, which are found in other heterodox monetary theories. It accounts for the new forms of monetary constraints weighing on the banking systems under and inconvertible fiat money standard, the class relationships underlying the interventions of monetary authorities and governments, and presents a definition of the state which emphasises its mode of intervention on the collective and social conditions of capitalisms which are money and labour power. The emphasis on the contradiction between these two types of monetary functions gives a more fundamental account of the conflict between the international role and the national origin of the dollar than the Triffin dilemma, which has been constantly overcome or deferred by the US since 1960. The author explains this evolution by demonstrating how, from the 1950s onwards, the dollar began a process of acquiring relative autonomy from the US economy. By focusing on the role and international functions of the dollar, he offers a fresh look at the 2008 crisis and its consequences for the international monetary system, but also for a possible post-capitalist financial system - which post-revolutionary Russia experimented with in the form of the NEP, and whose contemporary implementation is foreshadowed by the rise of digital central bank currencies.

The book thereby provides a necessary update to the tools and concepts inherited from Marx for analysing and understanding money, capital and the state.

Specificaties

Betrokkenen

- Auteur(s):

- Uitgeverij:

Inhoud

- Aantal bladzijden:

- 302

- Taal:

- Engels

- Reeks:

Eigenschappen

- Productcode (EAN):

- 9780367204051

- Verschijningsdatum:

- 30/12/2022

- Uitvoering:

- Hardcover

- Formaat:

- Genaaid

- Afmetingen:

- 156 mm x 233 mm

- Gewicht:

- 552 g

Alleen bij Standaard Boekhandel

Beoordelingen

We publiceren alleen reviews die voldoen aan de voorwaarden voor reviews. Bekijk onze voorwaarden voor reviews.