- Afhalen na 1 uur in een winkel met voorraad

- Gratis thuislevering in België vanaf € 30

- Ruim aanbod met 7 miljoen producten

- Afhalen na 1 uur in een winkel met voorraad

- Gratis thuislevering in België vanaf € 30

- Ruim aanbod met 7 miljoen producten

Zoeken

€ 64,95

+ 129 punten

Uitvoering

Omschrijving

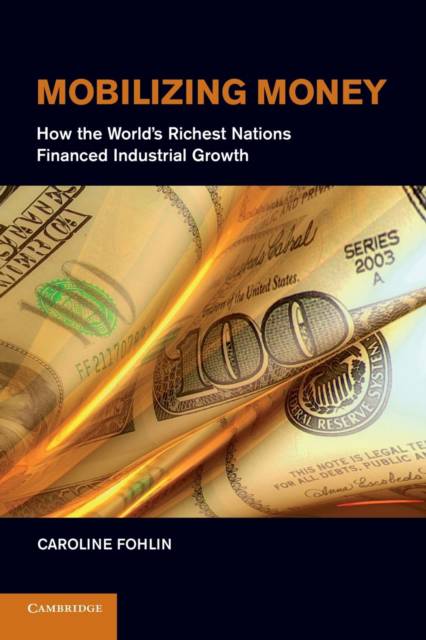

This book examines the origins of modern corporate finance systems during the rapid industrialization period leading up to World War I. The study leads to three sets of conclusions. First, modern financial systems are rooted in the past, are idiosyncratic to specific countries, and are highly path-dependent. Therefore, to understand current financial institutions, we must take stock of the forces at play in the near and distant past: political and regulatory intervention, natural resource endowments, educational institutions, and social and religious beliefs. Second, financial institutions and markets do not create economic growth without significant first steps in industrial development and supporting institutions. The finance-growth relationship also varies over time, as financial and economic developments influence one another and create a feedback mechanism. Third, and most important from the modern policy standpoint, there is no "one-size-fits-all" solution to financial system design and industrial development. Having specific types of financial institutions is far less important than developing a strong, stable, and legally protected financial system with a rich diversity of institutions and vibrant markets that can adapt to changing needs.

Specificaties

Betrokkenen

- Auteur(s):

- Uitgeverij:

Inhoud

- Aantal bladzijden:

- 280

- Taal:

- Engels

- Reeks:

Eigenschappen

- Productcode (EAN):

- 9781107436763

- Verschijningsdatum:

- 21/08/2014

- Uitvoering:

- Paperback

- Formaat:

- Trade paperback (VS)

- Afmetingen:

- 152 mm x 229 mm

- Gewicht:

- 412 g

Alleen bij Standaard Boekhandel

+ 129 punten op je klantenkaart van Standaard Boekhandel

Beoordelingen

We publiceren alleen reviews die voldoen aan de voorwaarden voor reviews. Bekijk onze voorwaarden voor reviews.