- Afhalen na 1 uur in een winkel met voorraad

- Gratis thuislevering in België vanaf € 30

- Ruim aanbod met 7 miljoen producten

- Afhalen na 1 uur in een winkel met voorraad

- Gratis thuislevering in België vanaf € 30

- Ruim aanbod met 7 miljoen producten

Zoeken

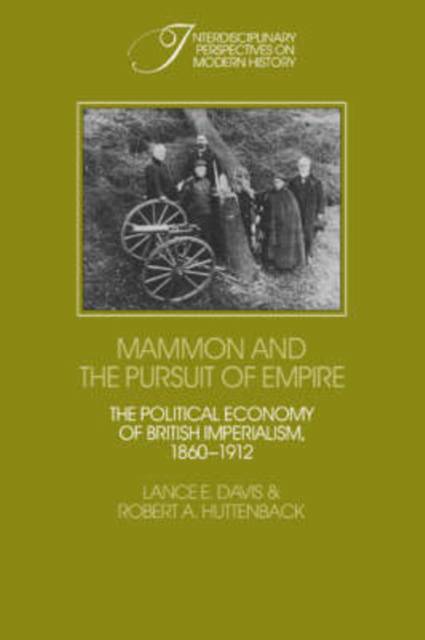

Mammon and the Pursuit of Empire

The Political Economy of British Imperialism, 1860 1912

Lance Edwin Davis, Robert A Huttenback

€ 237,95

+ 475 punten

Omschrijving

Historians have so far made few attempts to assess directly the costs and benefits of Britain's investment in empire. This book presents answers to some of the key questions about the economics of imperialism: how large was the flow of finance to the empire? How great were the profits on empire investment? What were the social costs of maintaining the empire? Who received the profits, and who bore the costs? The authors show that colonial finance did not dominate British capital markets; returns from empire investment were not high in comparison to earnings in the domestic and foreign sectors; there is no evidence of continued exploitative profits; and empire profits were earned at a substantial cost to the taxpayer. They depict British imperialism as a mechanism to effect an income transfer from the tax-paying middle class to the elites in which the ownership of imperial enterprise was heavily concentrated, with some slight net transfer to the colonies in the process.

Specificaties

Betrokkenen

- Auteur(s):

- Uitgeverij:

Inhoud

- Aantal bladzijden:

- 408

- Taal:

- Engels

- Reeks:

Eigenschappen

- Productcode (EAN):

- 9780521236119

- Verschijningsdatum:

- 30/01/1987

- Uitvoering:

- Hardcover

- Formaat:

- Genaaid

- Afmetingen:

- 156 mm x 234 mm

- Gewicht:

- 743 g

Alleen bij Standaard Boekhandel

+ 475 punten op je klantenkaart van Standaard Boekhandel

Beoordelingen

We publiceren alleen reviews die voldoen aan de voorwaarden voor reviews. Bekijk onze voorwaarden voor reviews.