- Afhalen na 1 uur in een winkel met voorraad

- Gratis thuislevering in België vanaf € 30

- Ruim aanbod met 7 miljoen producten

- Afhalen na 1 uur in een winkel met voorraad

- Gratis thuislevering in België vanaf € 30

- Ruim aanbod met 7 miljoen producten

Zoeken

€ 52,95

+ 105 punten

Omschrijving

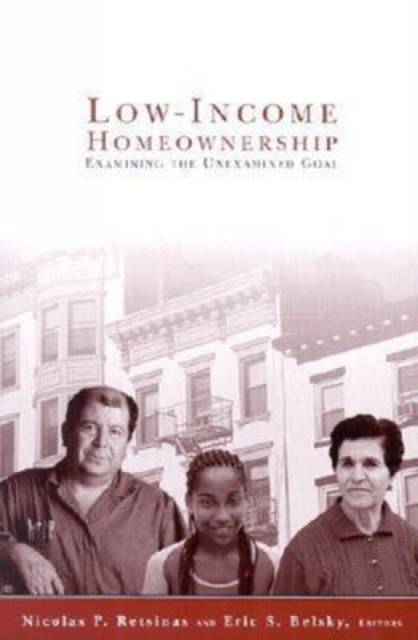

"A Brookings Institution Press and Harvard University Joint Center for Housing Studies publication A generation ago little attention was focused on low-income homeownership. Today homeownership rates among under-served groups, including low-income households and minorities, have risen to record levels. These groups are no longer at the margin of the housing market; they have benefited from more flexible underwriting standards and greater access to credit. However, there is still a racial/ethnic gap and the homeownership rates of minority and low-income households are still well below the national average. This volume gathers the observations of housing experts on low-income homeownership and its effects on households and communities. The book is divided into five chapters which focus on the following subjects: homeownership trends in the 1990s; overcoming borrower constraints; financial returns to low-income homeowners; low-income loan performance; and the socioeconomic impact of homeownership.

"

"

Specificaties

Betrokkenen

- Uitgeverij:

Inhoud

- Aantal bladzijden:

- 512

- Taal:

- Engels

- Reeks:

Eigenschappen

- Productcode (EAN):

- 9780815706137

- Verschijningsdatum:

- 13/08/2002

- Uitvoering:

- Paperback

- Formaat:

- Trade paperback (VS)

- Afmetingen:

- 154 mm x 238 mm

- Gewicht:

- 703 g

Alleen bij Standaard Boekhandel

+ 105 punten op je klantenkaart van Standaard Boekhandel

Beoordelingen

We publiceren alleen reviews die voldoen aan de voorwaarden voor reviews. Bekijk onze voorwaarden voor reviews.