- Afhalen na 1 uur in een winkel met voorraad

- Gratis thuislevering in België vanaf € 30

- Ruim aanbod met 7 miljoen producten

- Afhalen na 1 uur in een winkel met voorraad

- Gratis thuislevering in België vanaf € 30

- Ruim aanbod met 7 miljoen producten

Zoeken

€ 25,95

+ 51 punten

Omschrijving

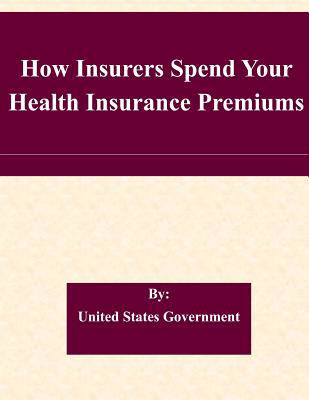

The Affordable Care Act holds health insurers accountable to consumers and ensures that American families receive value for their health insurance premium dollars. One such mechanism is the 80/20 rule, or Medical Loss Ratio (MLR) rule. The 80/20 rule brings consumers value, increases transparency and accountability, and promotes better business practices and competition among insurance companies. The 80/20 rule requires insurance companies to reveal how much of premium dollars they actually spend on health care and how much on profits and administrative costs such as salaries and marketing. Now, with the implementation of the 80/20 rule, consumers can see how insurance companies spend their premium dollars and make more informed decisions when purchasing health insurance. The 80/20 rule will become even more important beginning in 2014, when consumers and small employers will have access to state-based competitive Health Insurance Marketplaces (also known as Exchanges) where individuals and small businesses can use the 80/20 information to compare the value of health insurance plans. The 80/20 rule requires insurance companies to rebate any excess premium charged if they spend less than 80% of premiums on medical care and efforts to improve the quality of care (or at least 85% in the large group market). Under the 80/20 rule, insurance companies cannot keep more than 20% of premiums (or more than 15% in the large group market) for overhead and profits. Companies that spend 80% (85% in the large group market) or more on medical claims and improving health care quality already provide consumers with the required value for their premium dollars. In anticipation of the effective date of the 80/20 rule, some insurers have already modified their business practices and pricing to improve value to consumers for premium dollars.

Specificaties

Betrokkenen

- Auteur(s):

- Uitgeverij:

Inhoud

- Aantal bladzijden:

- 26

- Taal:

- Engels

Eigenschappen

- Productcode (EAN):

- 9781508858263

- Verschijningsdatum:

- 15/03/2015

- Uitvoering:

- Paperback

- Formaat:

- Trade paperback (VS)

- Afmetingen:

- 216 mm x 279 mm

- Gewicht:

- 108 g

Alleen bij Standaard Boekhandel

+ 51 punten op je klantenkaart van Standaard Boekhandel

Beoordelingen

We publiceren alleen reviews die voldoen aan de voorwaarden voor reviews. Bekijk onze voorwaarden voor reviews.