- Afhalen na 1 uur in een winkel met voorraad

- Gratis thuislevering in België vanaf € 30

- Ruim aanbod met 7 miljoen producten

- Afhalen na 1 uur in een winkel met voorraad

- Gratis thuislevering in België vanaf € 30

- Ruim aanbod met 7 miljoen producten

Zoeken

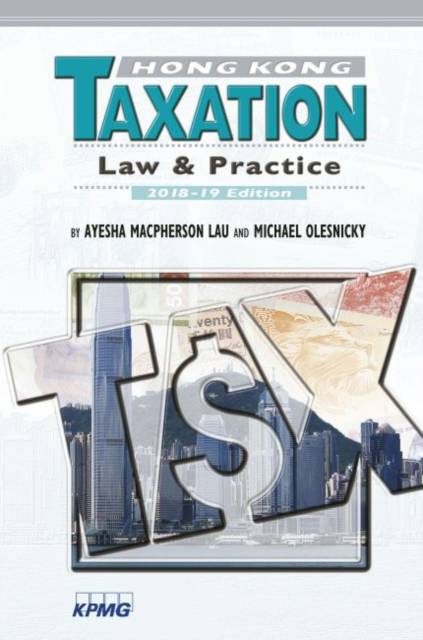

Hong Kong Taxation

Law and Practice, 2018-19 Edition

Ayesha MacPherson Lau, Michael Olesnicky

Paperback | Engels

€ 67,45

+ 134 punten

Uitvoering

Omschrijving

This book covers the major areas of Hong Kong taxation--profits tax, salaries tax, property tax, personal assessment, and stamp duty, as well as a general overview of international tax issues and how they pertain to Hong Kong. The book explains the principles and practice of Hong Kong taxation law together with the relevant Court and Board of Review decisions and contains numerous practical examples. The new edition includes legislative changes up to 31 July 2018 as well as the latest developments pertaining to the OECD's Base Erosion and Profit Shifting (BEPS) project and the proposed measures to be adopted by Hong Kong.

Specificaties

Betrokkenen

- Auteur(s):

- Uitgeverij:

Inhoud

- Aantal bladzijden:

- 1048

- Taal:

- Engels

Eigenschappen

- Productcode (EAN):

- 9789882371071

- Verschijningsdatum:

- 25/06/2019

- Uitvoering:

- Paperback

- Formaat:

- Trade paperback (VS)

- Afmetingen:

- 155 mm x 229 mm

- Gewicht:

- 1338 g

Alleen bij Standaard Boekhandel

+ 134 punten op je klantenkaart van Standaard Boekhandel

Beoordelingen

We publiceren alleen reviews die voldoen aan de voorwaarden voor reviews. Bekijk onze voorwaarden voor reviews.