- Afhalen na 1 uur in een winkel met voorraad

- Gratis thuislevering in België vanaf € 30

- Ruim aanbod met 7 miljoen producten

- Afhalen na 1 uur in een winkel met voorraad

- Gratis thuislevering in België vanaf € 30

- Ruim aanbod met 7 miljoen producten

Zoeken

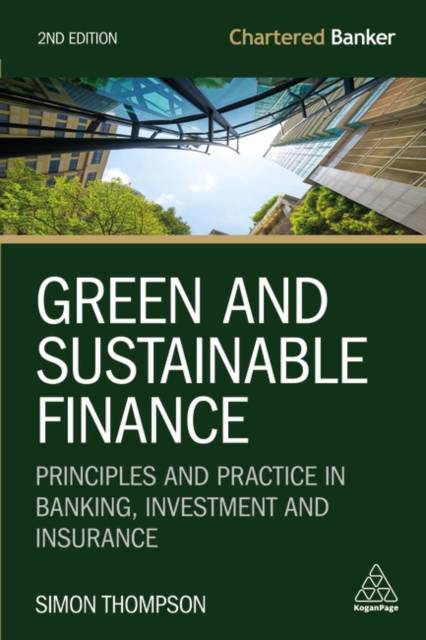

Green and Sustainable Finance

Principles and Practice in Banking, Investment and Insurance

Simon Thompson

€ 100,95

+ 201 punten

Uitvoering

Omschrijving

As nations continue to work towards a sustainable future, the finance sector has a crucial role to play in driving sustainable business and managing the transition to a net zero economy.

To achieve this change, it is vital for the finance sector to allocate capital to the firms, investments and projects looking to create a low carbon world. Green and Sustainable Finance offers a comprehensive guide to the application of common green and sustainable principles and practices in banking, investment and insurance to manage risks and seize opportunities in the transition to net zero. As climate change becomes an ever more pressing issue, it is essential that finance professionals grasp these principles to combat the threat of climate change and maximize the opportunities of a low-carbon future. Written by the CEO of the Chartered Banker Institute, this fully updated second edition includes much greater coverage of the reporting of environmental impacts and carbon accounting, regulatory and market developments in climate and environmental risk management, the rapid growth of sustainable investment, and the latest finance sector alliance and initiatives, including the COP26 Private Finance Strategy and Glasgow Financial Alliance for Net Zero (GFANZ). Endorsed by the CBI as the core text for the benchmark Certificate in Green and Sustainable Finance, this book is essential reading for finance professionals and students taking modules on Green and Sustainable Finance, and individuals working to embed sustainability in business, policy and regulation.Specificaties

Betrokkenen

- Auteur(s):

- Uitgeverij:

Inhoud

- Aantal bladzijden:

- 664

- Taal:

- Engels

- Reeks:

- Reeksnummer:

- nr. 7

Eigenschappen

- Productcode (EAN):

- 9781398609242

- Verschijningsdatum:

- 28/03/2023

- Uitvoering:

- Paperback

- Formaat:

- Trade paperback (VS)

- Afmetingen:

- 170 mm x 244 mm

- Gewicht:

- 1043 g

Alleen bij Standaard Boekhandel

+ 201 punten op je klantenkaart van Standaard Boekhandel

Beoordelingen

We publiceren alleen reviews die voldoen aan de voorwaarden voor reviews. Bekijk onze voorwaarden voor reviews.