- Afhalen na 1 uur in een winkel met voorraad

- Gratis thuislevering in België vanaf € 30

- Ruim aanbod met 7 miljoen producten

- Afhalen na 1 uur in een winkel met voorraad

- Gratis thuislevering in België vanaf € 30

- Ruim aanbod met 7 miljoen producten

Omschrijving

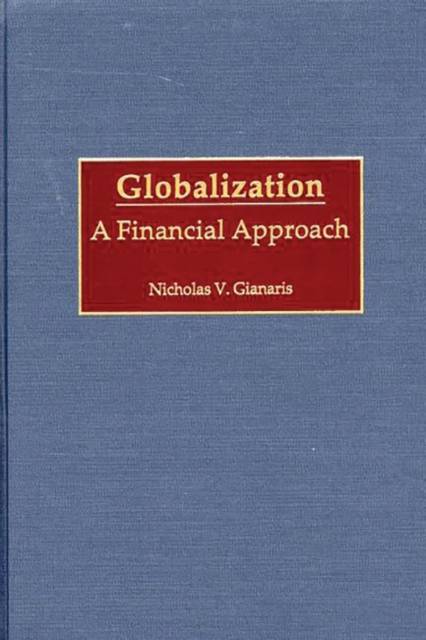

The global economy is undergoing dramatic financial changes. The removal of technical, trade, and monetary barriers and the liberalization of world economies create challenges and opportunities for investment and financial transactions. With these changes, international finance is expected to play a vital role in foreign exchange, cross-border capital flows, joint ventures, and economic growth, but rapid progress in telecommunications and electronic capital transfers could lead to tremors in financial markets, making the global economy vulnerable to speculation, investors' panic, and economic fluctuations. Supported by the latest empirical research, this book weaves together a theoretical framework of international finance supported by the latest empirical research.

^IGlobalization^R provides a comprehensive analysis of traditional and modern theories of international monetary systems, problems of balance of payments, exchange rates, and related adjustment and stabilization policies for industrialized and emerging nations. Following a brief historical review, the book covers advanced theories of international trade and finances as well as related real world performance. It examines strengths and weaknesses of fixed and floating exchange rates, forward exchanges, spreading global shareholder capitalism, problems of emerging markets, international capital movements and banking activities, market capitalization and foreign debt. It also examines investment movements and cross-border mergers, economic and financial integration, related effects of macroeconomic policies in open economies, and problems of global income inequalities. The book will be of great theoretical and practical importance to students, scholars, and business leaders.Specificaties

Betrokkenen

- Auteur(s):

- Uitgeverij:

Inhoud

- Aantal bladzijden:

- 272

- Taal:

- Engels

Eigenschappen

- Productcode (EAN):

- 9780275970765

- Verschijningsdatum:

- 30/10/2000

- Uitvoering:

- Hardcover

- Formaat:

- Genaaid

- Afmetingen:

- 163 mm x 241 mm

- Gewicht:

- 598 g

Alleen bij Standaard Boekhandel

Beoordelingen

We publiceren alleen reviews die voldoen aan de voorwaarden voor reviews. Bekijk onze voorwaarden voor reviews.