- Afhalen na 1 uur in een winkel met voorraad

- Gratis thuislevering in België vanaf € 30

- Ruim aanbod met 7 miljoen producten

- Afhalen na 1 uur in een winkel met voorraad

- Gratis thuislevering in België vanaf € 30

- Ruim aanbod met 7 miljoen producten

Omschrijving

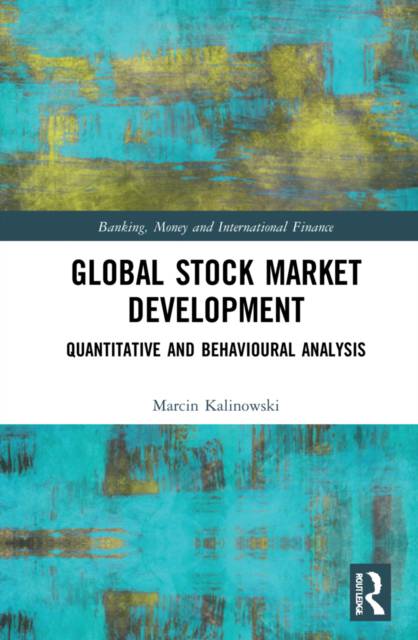

In the current era of globalised financial markets, the stock market cannot be assessed solely by comparing quantitative features such as the number of listed companies or capitalisation on the stock exchange. This is of secondary importance from an investor's point of view. What is important, however, is how a given stock market behaves towards the environment - whether it is 'hyperactive' or 'excessively lethargic' in response to information.

This book provides an innovative tool for assessing global stock markets. It describes the complex concept of 'stock market development' in light of classical and behavioural finance theories and considers both quantitative (the number of listed companies, turnover, etc.) and behavioural aspects (price volatility, the behaviour of fundamental indicators of listed companies). Based on an innovative method for assessing development, the author analyses 130 stock markets, indicating those that are more developed in terms of quantity and behaviour. Ultimately, this enables the assessment of which markets are more or less developed and why. This knowledge, used properly, offers an advantage over other financial market participants, and allows for the comprehensive assessment of individual stock markets, which can support the process of making good investment decisions.

The book is an invaluable resource for research fellows and students in economics, particularly the field of finance. It is also addressed to business and stock market practitioners, such as financial market analysts, brokers and investment advisers.

Specificaties

Betrokkenen

- Auteur(s):

- Uitgeverij:

Inhoud

- Aantal bladzijden:

- 176

- Taal:

- Engels

- Reeks:

- Reeksnummer:

- nr. 19

Eigenschappen

- Productcode (EAN):

- 9780367477042

- Verschijningsdatum:

- 27/09/2021

- Uitvoering:

- Hardcover

- Formaat:

- Genaaid

- Afmetingen:

- 156 mm x 234 mm

- Gewicht:

- 449 g

Alleen bij Standaard Boekhandel

Beoordelingen

We publiceren alleen reviews die voldoen aan de voorwaarden voor reviews. Bekijk onze voorwaarden voor reviews.