Door een staking bij bpost kan je online bestelling op dit moment iets langer onderweg zijn dan voorzien. Dringend iets nodig? Onze winkels ontvangen jou met open armen!

- Afhalen na 1 uur in een winkel met voorraad

- Gratis thuislevering in België vanaf € 30

- Ruim aanbod met 7 miljoen producten

Door een staking bij bpost kan je online bestelling op dit moment iets langer onderweg zijn dan voorzien. Dringend iets nodig? Onze winkels ontvangen jou met open armen!

- Afhalen na 1 uur in een winkel met voorraad

- Gratis thuislevering in België vanaf € 30

- Ruim aanbod met 7 miljoen producten

Zoeken

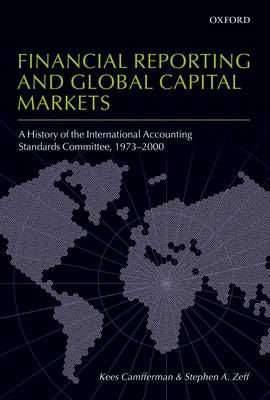

Financial Reporting and Global Capital Markets

A History of the International Accounting Standards Committee 1973-2000

Kees Camfferman, Stephen A Zeff

Hardcover | Engels

€ 356,95

+ 713 punten

Omschrijving

Standardization and harmonization of accounting practices is a fundamental element of a global business environment. Achieving this is a complex process that involves technical and political negotiation. The International Accounting Standards Committee (IASC) was the organization that pioneered this process on a world-wide basis. The IASC prepared the way for the International Accounting Standards Board (IASB) and its International Financial Reporting Standards, which since 2005 have held the dominant influence over the financial reporting of thousands of listed companies in the European Union, as well as in many other countries. The forces and influences that shaped the formation of the IASB were intimately connected with the historical organization and operation of its predecessor, the IASC, and so to understand the standards enforced in financial reporting today, a historical understanding of the IASC is required. Financial Reporting and Global Capital Markets does just this. It examines the history of the IASC from 1973 to 2000, including its foundation, operation, changing membership and leadership, achievements and setbacks, the development of its standards, and its restructuring leading up to the creation of the IASB in 2001. The book also studies the impact of the IASC's standards on national standard setting and on accounting practice in developed and developing countries, as well as the impact on the IASC of the policies and positions of the UN, the OECD, the US Securities and Exchange Commission, the International Organization of Securities Commissions, and the European Commission. It will be of vital interest to all concerned with accounting developments in a global environment, be they academics, policy-makers, or professionals.

Specificaties

Betrokkenen

- Auteur(s):

- Uitgeverij:

Inhoud

- Aantal bladzijden:

- 704

- Taal:

- Engels

Eigenschappen

- Productcode (EAN):

- 9780199296293

- Verschijningsdatum:

- 17/05/2007

- Uitvoering:

- Hardcover

- Formaat:

- Ongenaaid / garenloos gebonden

- Afmetingen:

- 166 mm x 241 mm

- Gewicht:

- 1174 g

Alleen bij Standaard Boekhandel

+ 713 punten op je klantenkaart van Standaard Boekhandel

Beoordelingen

We publiceren alleen reviews die voldoen aan de voorwaarden voor reviews. Bekijk onze voorwaarden voor reviews.