Bedankt voor het vertrouwen het afgelopen jaar! Om jou te bedanken bieden we GRATIS verzending aan op alles gedurende de hele maand januari.

- Afhalen na 1 uur in een winkel met voorraad

- Gratis thuislevering in België

- Ruim aanbod met 7 miljoen producten

Bedankt voor het vertrouwen het afgelopen jaar! Om jou te bedanken bieden we GRATIS verzending aan op alles gedurende de hele maand januari.

- Afhalen na 1 uur in een winkel met voorraad

- Gratis thuislevering in België

- Ruim aanbod met 7 miljoen producten

Zoeken

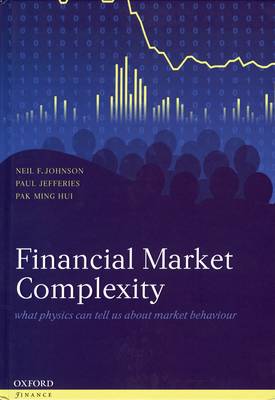

Financial Market Complexity

What Physics Can Tell Us about Market Behaviour

Neil F Johnson, Paul Jefferies, Pak Ming Hui

€ 156,45

+ 312 punten

Omschrijving

Financial markets are a fascinating example of 'complexity in action': a real-world complex system whose evolution is dictated by the decisions of crowds of traders who are continually trying to win in a vast global 'game'. This book draws on recent ideas from the highly- topical science of complexity and complex systems, to address the following questions: how do financial markets behave? Why do financial markets behave in the way that they do? What can we do to minimize risk, given this behavior? Standard finance theory is built around several seemingly innocuous assumptions about market dynamics. This book shows how these assumptions can give misleading answers to crucially important practical problems such as minimizing financial risk, coping with extreme events such as crashes or drawdowns, and pricing derivatives. After discussing the background to the concept of complexity and the structure of financial markets in Chapter 1, Chapter 2 examines the assumptions upon which

standard finance theory is built. Reality sets in which Chapter 3, where data from two seemingly different markets are analyzed and certain universal features uncovered which cannot be explained within standard finance theory. Chapters 4 and 5 mark a significant departure from the philosophy of standard finance theory, being concerned with exploring microscopic models of markets which are faithful to real market microstructure yet, which also reproduce real-world features. Chapter 6 moves to the practical problem of how to quantify and hedge risk in real world markets. Chapter 7 discusses deterministic descriptions of market dynamics, incorporating the topics of chaos and the all-important phenomenon of market crashes.

standard finance theory is built. Reality sets in which Chapter 3, where data from two seemingly different markets are analyzed and certain universal features uncovered which cannot be explained within standard finance theory. Chapters 4 and 5 mark a significant departure from the philosophy of standard finance theory, being concerned with exploring microscopic models of markets which are faithful to real market microstructure yet, which also reproduce real-world features. Chapter 6 moves to the practical problem of how to quantify and hedge risk in real world markets. Chapter 7 discusses deterministic descriptions of market dynamics, incorporating the topics of chaos and the all-important phenomenon of market crashes.

Specificaties

Betrokkenen

- Auteur(s):

- Uitgeverij:

Inhoud

- Aantal bladzijden:

- 264

- Taal:

- Engels

- Reeks:

Eigenschappen

- Productcode (EAN):

- 9780198526650

- Verschijningsdatum:

- 4/09/2003

- Uitvoering:

- Hardcover

- Formaat:

- Genaaid

- Afmetingen:

- 241 mm x 160 mm

- Gewicht:

- 578 g

Alleen bij Standaard Boekhandel

+ 312 punten op je klantenkaart van Standaard Boekhandel

Beoordelingen

We publiceren alleen reviews die voldoen aan de voorwaarden voor reviews. Bekijk onze voorwaarden voor reviews.