Bedankt voor het vertrouwen het afgelopen jaar! Om jou te bedanken bieden we GRATIS verzending (in België) aan op alles gedurende de hele maand januari.

- Afhalen na 1 uur in een winkel met voorraad

- In januari gratis thuislevering in België

- Ruim aanbod met 7 miljoen producten

Bedankt voor het vertrouwen het afgelopen jaar! Om jou te bedanken bieden we GRATIS verzending (in België) aan op alles gedurende de hele maand januari.

- Afhalen na 1 uur in een winkel met voorraad

- In januari gratis thuislevering in België

- Ruim aanbod met 7 miljoen producten

Zoeken

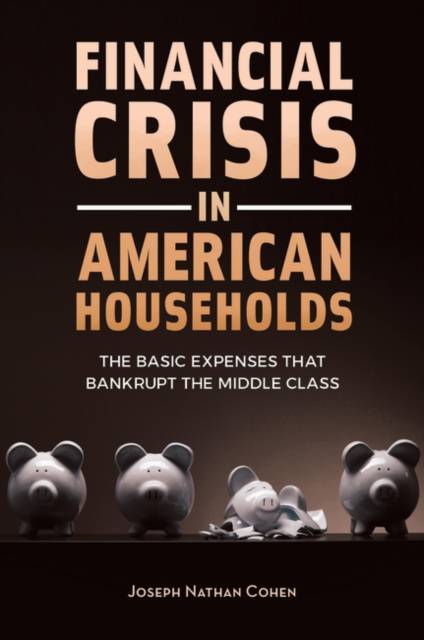

Financial Crisis in American Households

The Basic Expenses That Bankrupt the Middle Class

Joseph Cohen

Hardcover | Engels

€ 127,45

+ 254 punten

Omschrijving

More than one-third of Americans could not sustain a basic livelihood without government assistance. Almost 60 percent of seniors are dependent on the government. Why is this? This book examines how the U.S. economy's failure to deliver high-quality, universally accessible basic necessities is creating acute financial insecurity among the American middle class.

Over the past 30 years, America's middle class has grown more financially insecure. How much of this pressing problem is due to Americans' failure to restrain their spending versus their upwards spiraling--and increasingly necessary--expenditures on health care, education, and housing? And how can Americans choose between financial security and paying for essentials on a day-to-day basis? This book answers these tough questions and many more in its evaluation of a complex and contentious issue: how basic expenses of life in the 21st century are bankrupting American families. The book begins with a snapshot of U.S. household finances, an assessment of financial insecurity's prevalence across the nation, and a description of how American households have declined into their present precarious economic situation over the last three decades. The author's analysis then looks at how European countries pursue policies that make these essentials highly accessible and postulates that the socialization of these essentials in other countries has helped to solidify household finances and maintain living standards. The work uniquely focuses on the plight of the middle class in America to provide relevant, useful information to help as many readers as possible to better understand and improve their own financial situations.Specificaties

Betrokkenen

- Auteur(s):

- Uitgeverij:

Inhoud

- Aantal bladzijden:

- 224

- Taal:

- Engels

Eigenschappen

- Productcode (EAN):

- 9781440832215

- Verschijningsdatum:

- 24/04/2017

- Uitvoering:

- Hardcover

- Formaat:

- Genaaid

- Afmetingen:

- 157 mm x 236 mm

- Gewicht:

- 517 g

Alleen bij Standaard Boekhandel

+ 254 punten op je klantenkaart van Standaard Boekhandel

Beoordelingen

We publiceren alleen reviews die voldoen aan de voorwaarden voor reviews. Bekijk onze voorwaarden voor reviews.