- Afhalen na 1 uur in een winkel met voorraad

- Gratis thuislevering in België vanaf € 30

- Ruim aanbod met 7 miljoen producten

- Afhalen na 1 uur in een winkel met voorraad

- Gratis thuislevering in België vanaf € 30

- Ruim aanbod met 7 miljoen producten

Zoeken

€ 64,45

+ 128 punten

Omschrijving

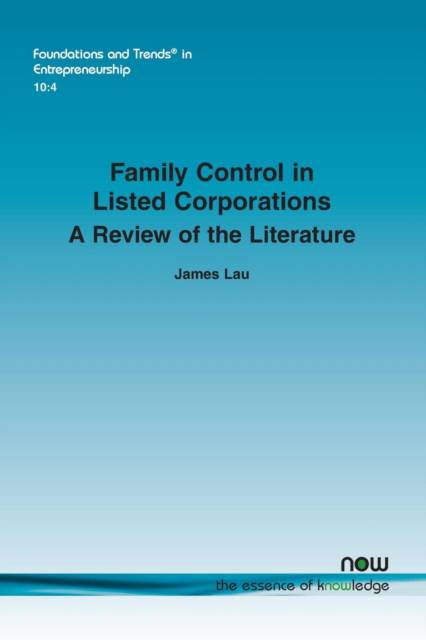

Given the significant representation of family firms across most major listed exchanges, there have been growing numbers of empirical studies in recent years that examine the impact of family control on corporate behavior. This book aims to synthesize selected published empirical studies in relation to listed family corporations. It discusses the empirical findings, evaluates the contribution of existing empirical studies, identifies the limitations of these studies, and provides future research directions. The review contributes to the family business literature in two ways. First, it discusses the empirical findings and it evaluates the contribution of existing empirical studies. Second, this monograph identifies the limitations of existing empirical studies and it provides future research directions. Section 2 discusses whether family control affects firm performance, and then reviews studies of the preference of family firms for various leverage and financing methods. Section 4 examines empirical evidence in relation to the corporate disclosure practices of family firms, and reviews the empirical studies of various corporate governance issues in family firms, which include the role of independent directors and institutional investors, and the use of control enhancing mechanisms by family shareholders. Section 6 considers the impact of family control on some socio-economic issues such as economic development, tax evasion and corporate downsizing. Finally, Section 7 discusses the limitations of the existing body of literature and provides suggestions for future research directions.

Specificaties

Betrokkenen

- Auteur(s):

- Uitgeverij:

Inhoud

- Aantal bladzijden:

- 100

- Taal:

- Engels

- Reeks:

- Reeksnummer:

- nr. 45

Eigenschappen

- Productcode (EAN):

- 9781601988720

- Verschijningsdatum:

- 20/03/2015

- Uitvoering:

- Paperback

- Formaat:

- Trade paperback (VS)

- Afmetingen:

- 156 mm x 234 mm

- Gewicht:

- 149 g

Alleen bij Standaard Boekhandel

+ 128 punten op je klantenkaart van Standaard Boekhandel

Beoordelingen

We publiceren alleen reviews die voldoen aan de voorwaarden voor reviews. Bekijk onze voorwaarden voor reviews.