- Afhalen na 1 uur in een winkel met voorraad

- Gratis thuislevering in België vanaf € 30

- Ruim aanbod met 7 miljoen producten

- Afhalen na 1 uur in een winkel met voorraad

- Gratis thuislevering in België vanaf € 30

- Ruim aanbod met 7 miljoen producten

Zoeken

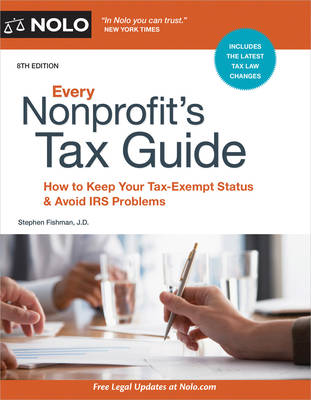

Every Nonprofit's Tax Guide

How to Keep Your Tax-Exempt Status & Avoid IRS Problems

Stephen Fishman

Paperback | Engels

€ 49,95

+ 99 punten

Uitvoering

Omschrijving

The

essential tax reference book for every nonprofit Nonprofits enjoy privileges not available to other

organizations. But these privileges come with obligations: Nonprofits must

comply with special IRS rules and regulations to maintain their tax-exempt

status. Practical, comprehensive, and easy to understand, Every Nonprofit's Tax Guide explains ongoing and

annual IRS compliance requirements for nonprofits, including: - a detailed

explanation of Form 990 - requirements

for filing Form 990-EZ electronically - how to file

Form 1099-NEC - conflicts of

interest and compensation rules - charitable

giving rules - unrelated

taxable business income rules - lobbying and

political activity restrictions, and - nonprofit

bookkeeping. Whether you are just starting your nonprofit or are well

established, you'll find all the information you need to avoid the most common

issues nonprofits run into with the IRS.

essential tax reference book for every nonprofit Nonprofits enjoy privileges not available to other

organizations. But these privileges come with obligations: Nonprofits must

comply with special IRS rules and regulations to maintain their tax-exempt

status. Practical, comprehensive, and easy to understand, Every Nonprofit's Tax Guide explains ongoing and

annual IRS compliance requirements for nonprofits, including: - a detailed

explanation of Form 990 - requirements

for filing Form 990-EZ electronically - how to file

Form 1099-NEC - conflicts of

interest and compensation rules - charitable

giving rules - unrelated

taxable business income rules - lobbying and

political activity restrictions, and - nonprofit

bookkeeping. Whether you are just starting your nonprofit or are well

established, you'll find all the information you need to avoid the most common

issues nonprofits run into with the IRS.

Specificaties

Betrokkenen

- Auteur(s):

- Uitgeverij:

Inhoud

- Aantal bladzijden:

- 480

- Taal:

- Engels

Eigenschappen

- Productcode (EAN):

- 9781413331158

- Verschijningsdatum:

- 26/09/2023

- Uitvoering:

- Paperback

- Formaat:

- Trade paperback (VS)

- Afmetingen:

- 175 mm x 226 mm

- Gewicht:

- 739 g

Alleen bij Standaard Boekhandel

+ 99 punten op je klantenkaart van Standaard Boekhandel

Beoordelingen

We publiceren alleen reviews die voldoen aan de voorwaarden voor reviews. Bekijk onze voorwaarden voor reviews.