Bedankt voor het vertrouwen het afgelopen jaar! Om jou te bedanken bieden we GRATIS verzending (in België) aan op alles gedurende de hele maand januari.

- Afhalen na 1 uur in een winkel met voorraad

- Gratis thuislevering in België vanaf € 30

- Ruim aanbod met 7 miljoen producten

Bedankt voor het vertrouwen het afgelopen jaar! Om jou te bedanken bieden we GRATIS verzending (in België) aan op alles gedurende de hele maand januari.

- Afhalen na 1 uur in een winkel met voorraad

- Gratis thuislevering in België vanaf € 30

- Ruim aanbod met 7 miljoen producten

Zoeken

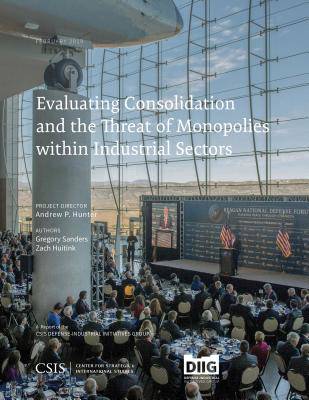

Evaluating Consolidation and the Threat of Monopolies within Industrial Sectors

Andrew P. Hunter, Gregory Sanders

€ 39,45

+ 78 punten

Omschrijving

Economics scholars and policymakers have rung alarm bells about the increasing threat of consolidation within industrial sectors. This paper examines the importance of industrial concentration in U.S. defense acquisition.

Specificaties

Betrokkenen

- Auteur(s):

- Uitgeverij:

Inhoud

- Aantal bladzijden:

- 76

- Reeks:

Eigenschappen

- Productcode (EAN):

- 9781442281011

- Verschijningsdatum:

- 1/04/2019

- Uitvoering:

- Paperback

- Afmetingen:

- 213 mm x 282 mm

- Gewicht:

- 227 g

Alleen bij Standaard Boekhandel

+ 78 punten op je klantenkaart van Standaard Boekhandel

Beoordelingen

We publiceren alleen reviews die voldoen aan de voorwaarden voor reviews. Bekijk onze voorwaarden voor reviews.