Door een staking bij bpost kan je online bestelling op dit moment iets langer onderweg zijn dan voorzien. Dringend iets nodig? Onze winkels ontvangen jou met open armen!

- Afhalen na 1 uur in een winkel met voorraad

- Gratis thuislevering in België vanaf € 30

- Ruim aanbod met 7 miljoen producten

Door een staking bij bpost kan je online bestelling op dit moment iets langer onderweg zijn dan voorzien. Dringend iets nodig? Onze winkels ontvangen jou met open armen!

- Afhalen na 1 uur in een winkel met voorraad

- Gratis thuislevering in België vanaf € 30

- Ruim aanbod met 7 miljoen producten

Zoeken

€ 202,45

+ 404 punten

Omschrijving

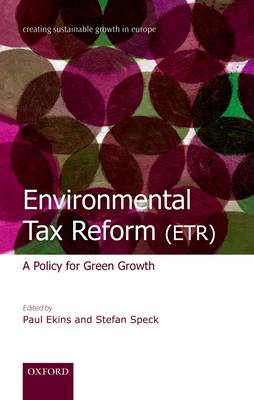

Many people have serious concerns about the environment and wonder whether solving environmental problems is compatible with continuing economic growth. This book provides an in-depth exploration of a proposed reform to the national tax system, whereby the burden of taxes is shifted from conventional taxes, such as those levied on labour and capital, to taxes on environmentally related activities, that involve resource use, particularly energy, or environmental pollution. There is some experience of such 'environmental tax reform' (ETR) in Europe, and the book briefly reviews this before considering how a more ambitious ETR in Europe could substantially reduce greenhouse gas emissions and material flows through the economy, while stimulating innovation and investment in the key 'clean and green' sectors of the economy which seem likely to play an increasing part in the creation of prosperity in Europe and elsewhere in the future. Case studies of renewable energy, construction, fuel-efficient vehicles, and waste management in Germany show how these fast-growing sectors are making an increasing contribution to employment, output, and exports in the German economy, while improving the environment. The book explores the implications of introducing it on a much wider scale throughout the European Union. A unique modelling exercise, using two macroeconomic models, delivers varied and complementary insights into the economic and environmental results of a large-scale ETR in Europe, and its effects on and implications for the rest of the world. The modelling suggests that such a policy has a key role in the achievement of Europe's targets to reduce its greenhouse gas emissions, and, if implemented with cooperative policy in other countries, could significantly reduce global emissions. The book is essential and hopeful reading for anyone who has wondered how, with today's intensifying environmental challenges, economic growth could become more environmentally sustainable.

Specificaties

Betrokkenen

- Auteur(s):

- Uitgeverij:

Inhoud

- Aantal bladzijden:

- 368

- Taal:

- Engels

- Reeks:

Eigenschappen

- Productcode (EAN):

- 9780199584505

- Verschijningsdatum:

- 26/05/2011

- Uitvoering:

- Hardcover

- Formaat:

- Ongenaaid / garenloos gebonden

- Afmetingen:

- 236 mm x 160 mm

- Gewicht:

- 757 g

Alleen bij Standaard Boekhandel

+ 404 punten op je klantenkaart van Standaard Boekhandel

Beoordelingen

We publiceren alleen reviews die voldoen aan de voorwaarden voor reviews. Bekijk onze voorwaarden voor reviews.