- Afhalen na 1 uur in een winkel met voorraad

- Gratis thuislevering in België vanaf € 30

- Ruim aanbod met 7 miljoen producten

- Afhalen na 1 uur in een winkel met voorraad

- Gratis thuislevering in België vanaf € 30

- Ruim aanbod met 7 miljoen producten

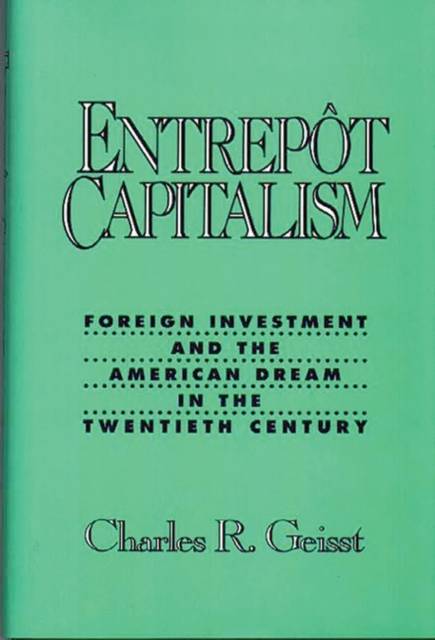

Entrepot Capitalism

Foreign Investment and the American Dream in the Twentieth Century

Charles R GeisstOmschrijving

This is the first history on the subject of foreign investment in the United States since 1920. It shows how the United States changed from a debtor nation to a supplier of capital to the rest of the world, and then details the structural shifts to this creditor position after the breakdown of the Bretton Woods system in 1972. Geisst demonstrates that the United States has always been a magnet for foreign portfolio and direct investment. Traditionally, this has come from northern European or Canadian sources, but in the 1970s the Japanese became a major force. Currently, both types of investment in the United States are at historically high levels, but Geisst asserts that this foreign interest exerts a positive rather than a negative impact on the economic climate.

This study is a counterpart to the author's earlier examination of domestic investment in the United States, Visionary Capitalism: Financial Markets and the American Dream in the Twentieth Century. It will be of interest to scholars and professionals in finance and investments, business history, and American history.Specificaties

Betrokkenen

- Auteur(s):

- Uitgeverij:

Inhoud

- Aantal bladzijden:

- 184

- Taal:

- Engels

Eigenschappen

- Productcode (EAN):

- 9780275938949

- Verschijningsdatum:

- 6/04/1992

- Uitvoering:

- Hardcover

- Formaat:

- Genaaid

- Afmetingen:

- 158 mm x 244 mm

- Gewicht:

- 489 g

Alleen bij Standaard Boekhandel

Beoordelingen

We publiceren alleen reviews die voldoen aan de voorwaarden voor reviews. Bekijk onze voorwaarden voor reviews.