- Afhalen na 1 uur in een winkel met voorraad

- Gratis thuislevering in België vanaf € 30

- Ruim aanbod met 7 miljoen producten

- Afhalen na 1 uur in een winkel met voorraad

- Gratis thuislevering in België vanaf € 30

- Ruim aanbod met 7 miljoen producten

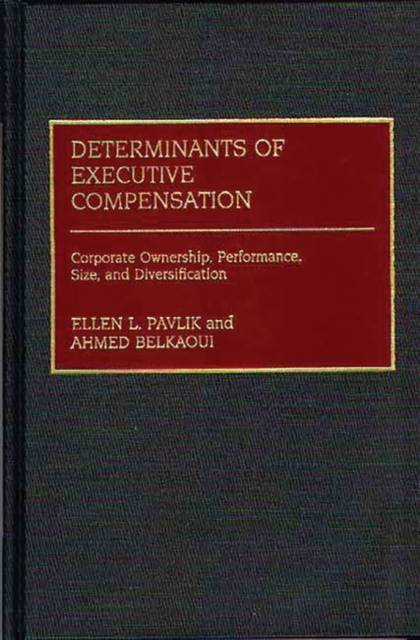

Determinants of Executive Compensation

Corporate Ownership, Performance, Size, and Diversification

Ahmed R Belkaoui, Ellen L Pavlik, Ahmed Riahi-BelkaouiOmschrijving

This study offers a thorough analysis of what determines the level of executive compensation in one corporation as opposed to another. Challenging prior research which has tended to focus solely on the influence of coporate financial performance, the authors argue that structural characteristics of the firm--size, internal organization, and ownership--are equally decisive in influencing the level and structure of executive compensation which allows for the investigation of both the direct and indirect effects of each of these factors on executive compensation and offer a guide to the assessment of executive compensation in the large corporation that will be of significant value to financial analysts, investors, and researchers interested in the role and ramifications of executive compensation policies.

Following a review of theoretical considerations and recent findings on the determination of executive compensation, the authors present a model of executive compensation which integrates the concepts of corporate performance, organizational structure, size, and ownership structure. This path model is then tested by utilizing data from a sample of over 200 Fortune 500 firms. Both regression results and path analysis results show significant direct and indirect effects of the structural variables tested. Based upon their results, the authors offer policy suggestions for those involved in determining executive compensation or evaluating the financial status of organizations under investment consideration.Specificaties

Betrokkenen

- Auteur(s):

- Uitgeverij:

Inhoud

- Aantal bladzijden:

- 178

- Taal:

- Engels

- Reeks:

Eigenschappen

- Productcode (EAN):

- 9780899306339

- Verschijningsdatum:

- 21/06/1991

- Uitvoering:

- Hardcover

- Formaat:

- Genaaid

- Afmetingen:

- 156 mm x 234 mm

- Gewicht:

- 426 g

Alleen bij Standaard Boekhandel

Beoordelingen

We publiceren alleen reviews die voldoen aan de voorwaarden voor reviews. Bekijk onze voorwaarden voor reviews.