- Afhalen na 1 uur in een winkel met voorraad

- Gratis thuislevering in België vanaf € 30

- Ruim aanbod met 7 miljoen producten

- Afhalen na 1 uur in een winkel met voorraad

- Gratis thuislevering in België vanaf € 30

- Ruim aanbod met 7 miljoen producten

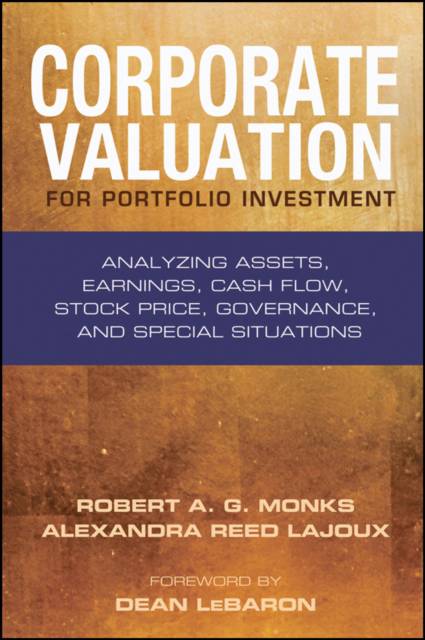

Corporate Valuation for Portfolio Investment

Analyzing Assets, Earnings, Cash Flow, Stock Price, Governance, and Special Situations

Robert A G Monks, Alexandra Reed LajouxOmschrijving

Designed for the professional investor who is building an investment portfolio that includes equity, Corporate Valuation for Portfolio Investment takes you through a range of approaches, including those primarily based on assets, earnings, cash flow, and securities prices, as well as hybrid techniques.

Along the way, it discusses the importance of qualitative measures such as governance, which go well beyond generally accepted accounting principles and international financial reporting standards, and addresses a variety of special situations in the life cycle of businesses, including initial public offerings and bankruptcies. Engaging and informative, Corporate Valuation for Portfolio Investment also contains formulas, checklists, and models that the authors, or other experts, have found useful in making equity investments.

- Presents more than a dozen hybrid approaches to valuation, explaining their relevance to different types of investors

- Charts stock market trends, both verbally and visually, enabling investors to think like traders when needed

- Offers valuation guidance based on less quantitative factors, namely management quality and factors relating to the company and the economy

Corporate Valuation for Portfolio Investment puts this dynamic discipline in perspective and presents proven ways to determine the value of corporate equity securities for the purpose of portfolio investment.

Specificaties

Betrokkenen

- Auteur(s):

- Uitgeverij:

Inhoud

- Aantal bladzijden:

- 576

- Taal:

- Engels

- Reeks:

- Reeksnummer:

- nr. 100

Eigenschappen

- Productcode (EAN):

- 9781576603178

- Verschijningsdatum:

- 9/11/2010

- Uitvoering:

- Hardcover

- Formaat:

- Ongenaaid / garenloos gebonden

- Afmetingen:

- 155 mm x 229 mm

- Gewicht:

- 793 g

Alleen bij Standaard Boekhandel

Beoordelingen

We publiceren alleen reviews die voldoen aan de voorwaarden voor reviews. Bekijk onze voorwaarden voor reviews.