- Afhalen na 1 uur in een winkel met voorraad

- Gratis thuislevering in België vanaf € 30

- Ruim aanbod met 7 miljoen producten

- Afhalen na 1 uur in een winkel met voorraad

- Gratis thuislevering in België vanaf € 30

- Ruim aanbod met 7 miljoen producten

Zoeken

Omschrijving

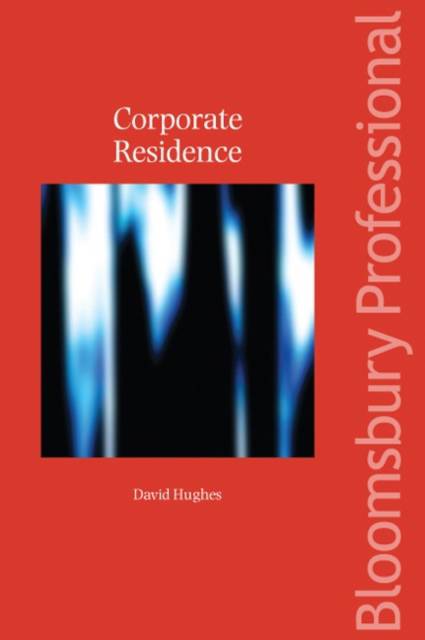

The question of where a company is actually resident has become increasingly significant, with the international nature of so many business transaction, including e-commerce transactions. This title examines the UK's approach to determining the residence status of corporations and thus their exposure to UK tax.

Specificaties

Betrokkenen

- Auteur(s):

- Uitgeverij:

Inhoud

- Aantal bladzijden:

- 302

Eigenschappen

- Productcode (EAN):

- 9781847663696

- Verschijningsdatum:

- 30/10/2013

- Uitvoering:

- Paperback

- Afmetingen:

- 160 mm x 231 mm

- Gewicht:

- 470 g

Alleen bij Standaard Boekhandel

+ 391 punten op je klantenkaart van Standaard Boekhandel

Beoordelingen

We publiceren alleen reviews die voldoen aan de voorwaarden voor reviews. Bekijk onze voorwaarden voor reviews.