Door een staking bij bpost kan je online bestelling op dit moment iets langer onderweg zijn dan voorzien. Dringend iets nodig? Onze winkels ontvangen jou met open armen!

- Afhalen na 1 uur in een winkel met voorraad

- Gratis thuislevering in België vanaf € 30

- Ruim aanbod met 7 miljoen producten

Door een staking bij bpost kan je online bestelling op dit moment iets langer onderweg zijn dan voorzien. Dringend iets nodig? Onze winkels ontvangen jou met open armen!

- Afhalen na 1 uur in een winkel met voorraad

- Gratis thuislevering in België vanaf € 30

- Ruim aanbod met 7 miljoen producten

Zoeken

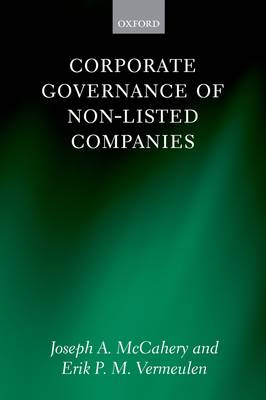

Corporate Governance of Non-Listed Companies

Joseph A McCahery, Erik P M Vermeulen

Paperback | Engels

€ 78,45

+ 156 punten

Omschrijving

Studies of corporate governance traditionally focus on the governance problems of large publicly held firms, and policymakers' recommendations often focus on such firms. However most small firms, and in many countries, even many large companies, are non-listed. Corporate Governance of Non-Listed Companies provides a comprehensive account of non-listed businesses and their particular governance problems. It explores current discussions and reforms in Europe, the United States, and Asia providing a state of the art account of the law and the economics. Non-listed firms encompass a vast range, from corporations with the potential to go public through family-owned firms, group-owned firms, private equity and hedge funds, to joint ventures and unlisted mass-privatized corporations with a relatively high number of shareholders. The governance of non-listed companies has traditionally been concerned with protecting investors and creditors from managerial opportunism. However, the virtual elimination of the distinction between partnerships and corporations means that an effective legal governance framework must also offer mechanisms to protect shareholders from the misconduct of other shareholders. This volume examines policy and economic measurements to develop a framework for understanding what constitutes good governance in non-listed companies. The authors examine how control is gained and explore the mechanisms that contribute to the development of a modern and efficient governance framework. The book concludes with an exploration of how the closely held firm is likely to stimulate growth and extend innovation and development.

Specificaties

Betrokkenen

- Auteur(s):

- Uitgeverij:

Inhoud

- Aantal bladzijden:

- 330

- Taal:

- Engels

Eigenschappen

- Productcode (EAN):

- 9780199596386

- Verschijningsdatum:

- 19/11/2010

- Uitvoering:

- Paperback

- Formaat:

- Trade paperback (VS)

- Afmetingen:

- 229 mm x 150 mm

- Gewicht:

- 476 g

Alleen bij Standaard Boekhandel

+ 156 punten op je klantenkaart van Standaard Boekhandel

Beoordelingen

We publiceren alleen reviews die voldoen aan de voorwaarden voor reviews. Bekijk onze voorwaarden voor reviews.