- Afhalen na 1 uur in een winkel met voorraad

- Gratis thuislevering in België vanaf € 30

- Ruim aanbod met 7 miljoen producten

- Afhalen na 1 uur in een winkel met voorraad

- Gratis thuislevering in België vanaf € 30

- Ruim aanbod met 7 miljoen producten

Omschrijving

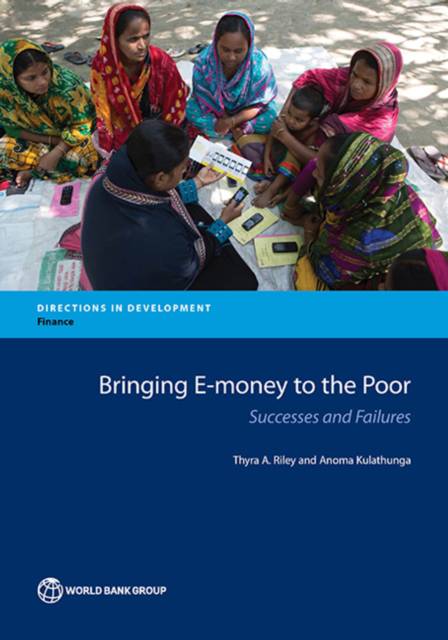

Moving towards universal access to financial services is within reach - thanks to new technologies, transformative business models and ambitious reforms. Such instruments as e-money accounts, along with debit cards and low-cost regular bank accounts, can significantly increase financial access for those who are now excluded. The purpose of this publication is to learn the lessons of success from 4 country case studies of "Gazelles" - Kenya, Thailand, Sri Lanka and South Africa - that have transformed the landscape of financial access to the poor by successfully enabling the deployment of e-money technology. 2 country case studies (Philippines and Maldives) yield lessons learned from constraints that stalled e-money deployments. Because Technology is not a silver bullet, the case studies explore "What are the other strategic elements that need to be in place in order for a country to guide increased financial access through digital technology?"

Specificaties

Betrokkenen

- Auteur(s):

- Uitgeverij:

Inhoud

- Aantal bladzijden:

- 242

- Taal:

- Engels

- Reeks:

Eigenschappen

- Productcode (EAN):

- 9781464804625

- Verschijningsdatum:

- 11/09/2017

- Uitvoering:

- Paperback

- Formaat:

- Trade paperback (VS)

- Afmetingen:

- 178 mm x 254 mm

- Gewicht:

- 430 g

Alleen bij Standaard Boekhandel

Beoordelingen

We publiceren alleen reviews die voldoen aan de voorwaarden voor reviews. Bekijk onze voorwaarden voor reviews.