Je cadeautjes zeker op tijd in huis hebben voor de feestdagen? Kom langs in onze winkels en vind het perfecte geschenk!

- Afhalen na 1 uur in een winkel met voorraad

- Gratis thuislevering in België vanaf € 30

- Ruim aanbod met 7 miljoen producten

Je cadeautjes zeker op tijd in huis hebben voor de feestdagen? Kom langs in onze winkels en vind het perfecte geschenk!

- Afhalen na 1 uur in een winkel met voorraad

- Gratis thuislevering in België vanaf € 30

- Ruim aanbod met 7 miljoen producten

Zoeken

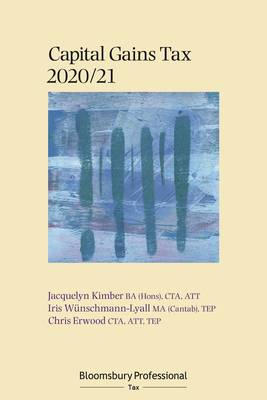

Bloomsbury Professional Capital Gains Tax 2020/21

Jacquelyn Kimber, Chris Erwood, Iris Wünschmann-Lyall

€ 139,95

+ 279 punten

Omschrijving

Taking on a practical approach to the subject and concentrating on the most commonly found transactions and reliefs, Capital Gains Tax 2020/21 is an invaluable title for those who deal with capital gains tax on a regular basis.

The latest edition examines the current legislation and HMRC guidance in a clear, comprehensive style and explores the following: - The introduction of a requirement for UK resident individuals, trustees and PRs to report and make payments on account of CGT due on disposals of residential property within 30 days of completion. Previously, the 30-day payment and reporting regime had applied only to non-UK residents- The reduction in the lifetime limit for entrepreneurs' relief from £10m to £1m for disposals on or after 11 March 2020

- The renaming of ER to business asset disposal relief

- The reduction in the final period exemption for main residence relief from 18 months to 9 months

- The restriction of lettings relief to periods where the owner occupies a main residence alongside a tenant

- The introduction of a restriction on the set off of capital losses for companies from 1 April 2020, where carried forward losses are above the £5m deductions allowance

- Case law - Henkes v HMRC [2020] UKFTT 159 (TC) Tribunal jurisdiction to consider domicile The commentary in this title includes numerous examples, updated to the current tax year, and is cross-referenced to the tax legislation as well as to the HMRC manuals and to other HMRC guidance. This accessible reference guide has a user-friendly structure with 'signposts' at the beginning of each chapter to summarise key topics and 'focus points' throughout to highlight important issues, as well as numerous worked examples demonstrating how to apply the main principles in practice.

Specificaties

Betrokkenen

- Auteur(s):

- Uitgeverij:

Inhoud

- Aantal bladzijden:

- 664

- Taal:

- Engels

- Reeks:

Eigenschappen

- Productcode (EAN):

- 9781526514660

- Verschijningsdatum:

- 24/12/2020

- Uitvoering:

- Paperback

- Formaat:

- Trade paperback (VS)

- Afmetingen:

- 156 mm x 237 mm

- Gewicht:

- 1029 g

Alleen bij Standaard Boekhandel

+ 279 punten op je klantenkaart van Standaard Boekhandel

Beoordelingen

We publiceren alleen reviews die voldoen aan de voorwaarden voor reviews. Bekijk onze voorwaarden voor reviews.