- Afhalen na 1 uur in een winkel met voorraad

- Gratis thuislevering in België vanaf € 30

- Ruim aanbod met 7 miljoen producten

- Afhalen na 1 uur in een winkel met voorraad

- Gratis thuislevering in België vanaf € 30

- Ruim aanbod met 7 miljoen producten

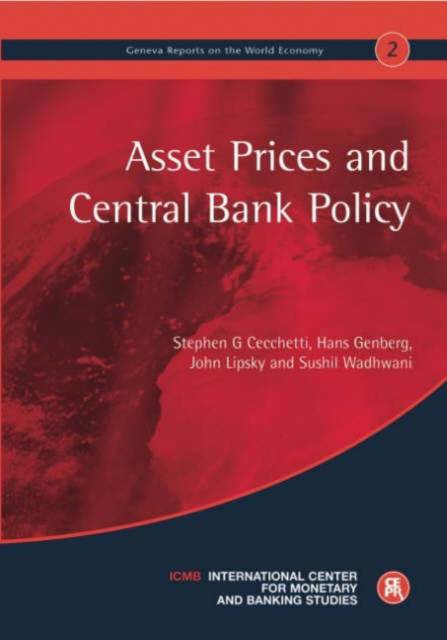

Asset Prices and Central Bank Policy

Geneva Reports on the World Economy 2

Steven G Cecchetti, Hans Genberg, John Lipsky, Sushil WadhwaniOmschrijving

How should central banks view movements in equity, housing and foreign exchange markets? Can policy-makers improve economic performance by paying attention to asset prices, as well as inflation and output forecasts? Is it possible to identify asset price misalignments and bubbles? Is it possible to use non-conventional policies to address asset price misalignments? Should asset prices be included directly in measures of inflation? Do asset prices contain information about future consumer price inflation? This is the second report in a series of Geneva Reports on the World Economy, organized by the Center for International Monetary and Banking Studies, Geneva, in conjunction with the Centre for Economic Policy Research.

Specificaties

Betrokkenen

- Auteur(s):

- Uitgeverij:

Inhoud

- Aantal bladzijden:

- 140

- Taal:

- Engels

- Reeks:

- Reeksnummer:

- nr. 1

Eigenschappen

- Productcode (EAN):

- 9781898128533

- Verschijningsdatum:

- 1/08/2000

- Uitvoering:

- Paperback

- Formaat:

- Trade paperback (VS)

- Afmetingen:

- 171 mm x 248 mm

- Gewicht:

- 42 g

Alleen bij Standaard Boekhandel

Beoordelingen

We publiceren alleen reviews die voldoen aan de voorwaarden voor reviews. Bekijk onze voorwaarden voor reviews.