- Afhalen na 1 uur in een winkel met voorraad

- Gratis thuislevering in België vanaf € 30

- Ruim aanbod met 7 miljoen producten

- Afhalen na 1 uur in een winkel met voorraad

- Gratis thuislevering in België vanaf € 30

- Ruim aanbod met 7 miljoen producten

Zoeken

Omschrijving

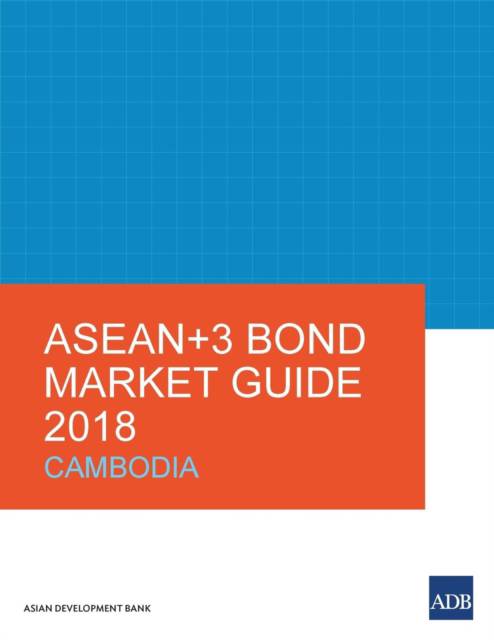

This Bond Market Guide reports on the significant developments expected in Cambodia's bond market, including the issuance of corporate and government bonds and subsequent debt securities listings on the Cambodia Securities Exchange.

Among the long-term development objectives of Cambodia's Financial Sector Development Strategy 20112020 were to develop the government securities market and to issue government bonds by the National Treasury. In 2010, the Cambodia Securities Exchange (CSX) was established. The National Bank of Cambodia began issuing negotiable certificates of deposit in 2013, effectively creating an interbank money market.

Fundamental legislation and key legislation for the securities market came into effect in 2007 with the adoption of the Law on Government Securities and the Law on the Issuance and Trading of Non-Government Securities. The Securities and Exchange Commission of Cambodia (SECC) was inaugurated in 2008 and it has been gradually establishing the necessary regulatory framework and practices for a corporate bond market. The CSX has been operating since 2010 and features comprehensive listing rules. While the present listings are limited to equities, it is expected that the CSX will allow the listing and trading of debt securities as well.

Among the long-term development objectives of Cambodia's Financial Sector Development Strategy 20112020 were to develop the government securities market and to issue government bonds by the National Treasury. In 2010, the Cambodia Securities Exchange (CSX) was established. The National Bank of Cambodia began issuing negotiable certificates of deposit in 2013, effectively creating an interbank money market.

Fundamental legislation and key legislation for the securities market came into effect in 2007 with the adoption of the Law on Government Securities and the Law on the Issuance and Trading of Non-Government Securities. The Securities and Exchange Commission of Cambodia (SECC) was inaugurated in 2008 and it has been gradually establishing the necessary regulatory framework and practices for a corporate bond market. The CSX has been operating since 2010 and features comprehensive listing rules. While the present listings are limited to equities, it is expected that the CSX will allow the listing and trading of debt securities as well.

Specificaties

Betrokkenen

- Auteur(s):

- Uitgeverij:

Inhoud

- Aantal bladzijden:

- 78

- Taal:

- Engels

- Reeks:

Eigenschappen

- Productcode (EAN):

- 9789292610661

- Verschijningsdatum:

- 28/04/2018

- Uitvoering:

- Paperback

- Formaat:

- Trade paperback (VS)

- Afmetingen:

- 216 mm x 279 mm

- Gewicht:

- 272 g

Alleen bij Standaard Boekhandel

+ 57 punten op je klantenkaart van Standaard Boekhandel

Beoordelingen

We publiceren alleen reviews die voldoen aan de voorwaarden voor reviews. Bekijk onze voorwaarden voor reviews.