Wil je zeker zijn dat je cadeautjes op tijd onder de kerstboom liggen? Onze winkels ontvangen jou met open armen. Nu met extra openingsuren op zondag!

- Afhalen na 1 uur in een winkel met voorraad

- Gratis thuislevering in België vanaf € 30

- Ruim aanbod met 7 miljoen producten

Wil je zeker zijn dat je cadeautjes op tijd onder de kerstboom liggen? Onze winkels ontvangen jou met open armen. Nu met extra openingsuren op zondag!

- Afhalen na 1 uur in een winkel met voorraad

- Gratis thuislevering in België vanaf € 30

- Ruim aanbod met 7 miljoen producten

Zoeken

€ 183,45

+ 366 punten

Omschrijving

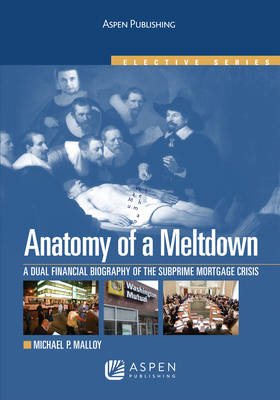

Anatomy of a Meltdown: A Dual Financial Biography of the Subprime Mortgage Crisis, traces the course of two financial icons, Lehman Brothers and WaMuâ "one operating in the investment sector, the other in the consumer financial services sectorâ "on their path to financial ruin. Illuminating the nature and severity of the subprime mortgage crisis, author Michael P. Malloy presents a clear and cogent analysis of the global economic meltdown, the steps necessary to restore the financial markets, and measures that must be taken to avoid similar crises in the future.

This clear and concise text by one of the foremost authorities on bank regulation features:

- comprehensive coverage of all of the fundamental law, policy, and practical issues raised by the crisis and the government's response to it

- the core of key cases preserved in timely and salient excerpts

- a balanced policy perspective

- step-by-step, highly readable analysis of the practical and policy implications of the subprime mortgage crisis

- the author's cutting-edge web log that offers continuously updated supplemental material

- generous use of examples throughout the text

- effective use of visual aids to illustrate concepts and spark class discussion

Anatomy of a Meltdown: A Dual Financial Biography of the Subprime Mortgage Crisis, by Michael P. Malloy tells the story of the financial meltdown that swept through American and international markets, threatening to plunge the United States into depression as Wall Street and the global economy faced near-total collapse.

Specificaties

Betrokkenen

- Auteur(s):

- Uitgeverij:

Inhoud

- Aantal bladzijden:

- 304

- Taal:

- Engels

- Reeks:

Eigenschappen

- Productcode (EAN):

- 9780735594586

- Verschijningsdatum:

- 1/08/2010

- Uitvoering:

- Paperback

- Formaat:

- Trade paperback (VS)

- Afmetingen:

- 175 mm x 251 mm

- Gewicht:

- 539 g

Alleen bij Standaard Boekhandel

+ 366 punten op je klantenkaart van Standaard Boekhandel

Beoordelingen

We publiceren alleen reviews die voldoen aan de voorwaarden voor reviews. Bekijk onze voorwaarden voor reviews.