- Afhalen na 1 uur in een winkel met voorraad

- Gratis thuislevering in België vanaf € 30

- Ruim aanbod met 7 miljoen producten

- Afhalen na 1 uur in een winkel met voorraad

- Gratis thuislevering in België vanaf € 30

- Ruim aanbod met 7 miljoen producten

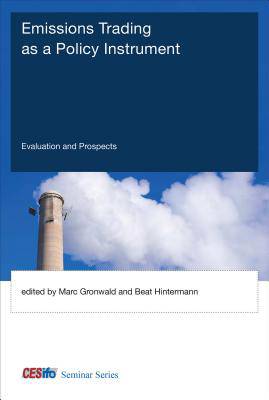

Emissions Trading as a Policy Instrument

Evaluation and Prospects

Omschrijving

Empirical and theoretical perspectives on the first two phases of the European Emissions Trading Scheme, the largest cap-and-trade market established so far.

Emissions trading schemes figure prominently among policy instruments used to tackle the problem of climate change, and the European Union Emissions Trading Scheme (EU ETS), begun in 2005, is the largest cap-and-trade market so far established. In the EU ETS, firms regulated by the scheme are provided with emissions allowances (each a one-time right to emit one ton of greenhouse gases) and can sell their unused allowances to firms that have higher rates of emissions. In this volume, leading economists offer empirical and theoretical perspectives on the early phases of the EU ETS implementation.

The contributors discuss the features of the EU ETS market; and regulatory uncertainty stemming from rule changes; the political economy context of the trading scheme, including allowance allocation and the influence of lobbying on abatement decisions; the coexistence of such overlapping instruments for climate policy as pricing and taxation; the relationship between spot and futures markets for allowances, and firms' responses to various features of the EU ETS, including fluctuating allowance prices, free allocation, and links to the Kyoto process. They show that, although the basic theory behind emissions permit markets is straightforward, design features, market structure, and interactions with other policy instruments can influence the efficiency of the scheme.

Contributors

Nathan Braun, A. Denny Ellerman, Timothy Fitzgerald, Beat Hintermann, Wolfgang Härdle, Peter Heindl, Philipp Hieronymi, Marc Gronwald, Frank Jotzo, Andreas Lange, Stephen Lecourt, Ralf Martin, A. J. Mulder, Mirabelle Muûls, Clement Pallière, Jason Pearcy, Oliver Sartor, David Schüller, Stefan Trück, Ulrich J. Wagner, Rafal Weron, Peter J. Wood

Specificaties

Betrokkenen

- Uitgeverij:

Inhoud

- Aantal bladzijden:

- 304

- Taal:

- Engels

- Reeks:

Eigenschappen

- Productcode (EAN):

- 9780262029285

- Verschijningsdatum:

- 10/07/2015

- Uitvoering:

- Hardcover

- Formaat:

- Genaaid

- Afmetingen:

- 157 mm x 236 mm

- Gewicht:

- 544 g

Alleen bij Standaard Boekhandel

Beoordelingen

We publiceren alleen reviews die voldoen aan de voorwaarden voor reviews. Bekijk onze voorwaarden voor reviews.